In the intricate world of financial accounting, understanding the cost structures of products is paramount. “Process Costings” stands as a beacon for industries that thrive on standardized production. But, like all methodologies, it comes with its own set of challenges that require effective solutions. In this article, we’ll unravel the necessity of process costing, explore the obstacles it presents, and delve into strategies to overcome them, ensuring a streamlined and efficient costing system for businesses.

Table of Contents

1. Definition and the importance of process costing

2. The need for accurate cost allocation in manufacturing

3. Process Costing Explanation

4. Example of Process Costing

5. Process Costing vs. Job Costing: A Comparative Analysis

6. Tracing the Cost Flow in Process Costing

7. Benefits of Process Costing

8. Challenges of Process Costing

9. Improve Efficiency in Process Costing with IBN Tech

10. Conclusion

11. FAQs

Definition and the importance of process costing

At its core, process costing is an accounting method tailored to the manufacturing industry. It plays a vital role in offering accurate cost insights, which in turn empowers businesses to make decisions about pricing, analyze profitability, and control costs, ensuring the organization’s financial well-being.

The need for accurate cost allocation in manufacturing

In the competitive world of manufacturing, even minor errors in cost allocation can lead to mispriced products, thereby impacting profitability. It’s pivotal for businesses to have a clear understanding of resource utilization, product pricing, and potential areas for cost savings. Process costing aids in this by ensuring that costs are equitably distributed, painting a lucid picture of a firm’s financial status.

Process Costing Explanation

For businesses employing process costing, the products are often homogeneous, which means the products are identical or very alike. This homogeneity simplifies the costing process, eliminating the need for individual product cost tracking.

Example of Process Costing

Process cost accounting is commonly applied when dealing with uniform product units. To better understand its application, let’s consider a hypothetical scenario.

Example- Aero Labs manufactures wind tunnel systems designed for use by educators and researchers, including organizations like NASA. Typically, they produce and sell 7-8 wind tunnels annually. This production involves the acquisition of various raw materials, including fans, vanes, base EWT parts, motors, as well as paint and hardware. These raw materials, like fans and vanes, are continuously used throughout the production process, resulting in the creation of identical wind tunnels.

For illustrative purposes, let’s focus on a specific scenario: Aero Labs receives an order for a single unit, which is intended for use by NASA. The cost breakdown for this unit includes $91,267 for raw materials, $14,000 in direct labor, and $60,000 in overhead expenses. These overhead expenses cover items such as power, maintenance, and indirect expenditures. Consequently, the total cost for producing a single unit amounts to $165,267.

Process Costing vs. Job Costing: A Comparative Analysis

Process costing and job costing are methodologies used to determine the cost of products. Job costing is ideal for industries producing unique, custom-made units, whereas process costings caters to sectors with standardized, continuous production. While both systems utilize similar journal entries, process costing is deemed suitable for many industries due to its adaptability. It allows for easy transition to job costing or even a hybrid approach, without significant restructuring of the chart of accounts. Let’s delve into their fundamental differences.

| Process Costing | Job Costing |

|---|---|

| Suited for industries with standard, continuous production (e.g., manufacturing, chemicals) | Ideal for custom industries (e.g., construction, custom manufacturing, services) |

| Costs are averaged over a time frame and allocated per unit or batch | Tracks costs for specific jobs or projects |

| Focuses on cost control in continuous processes with minor variations | Offers detailed cost insights for each job, aiding in precise costing |

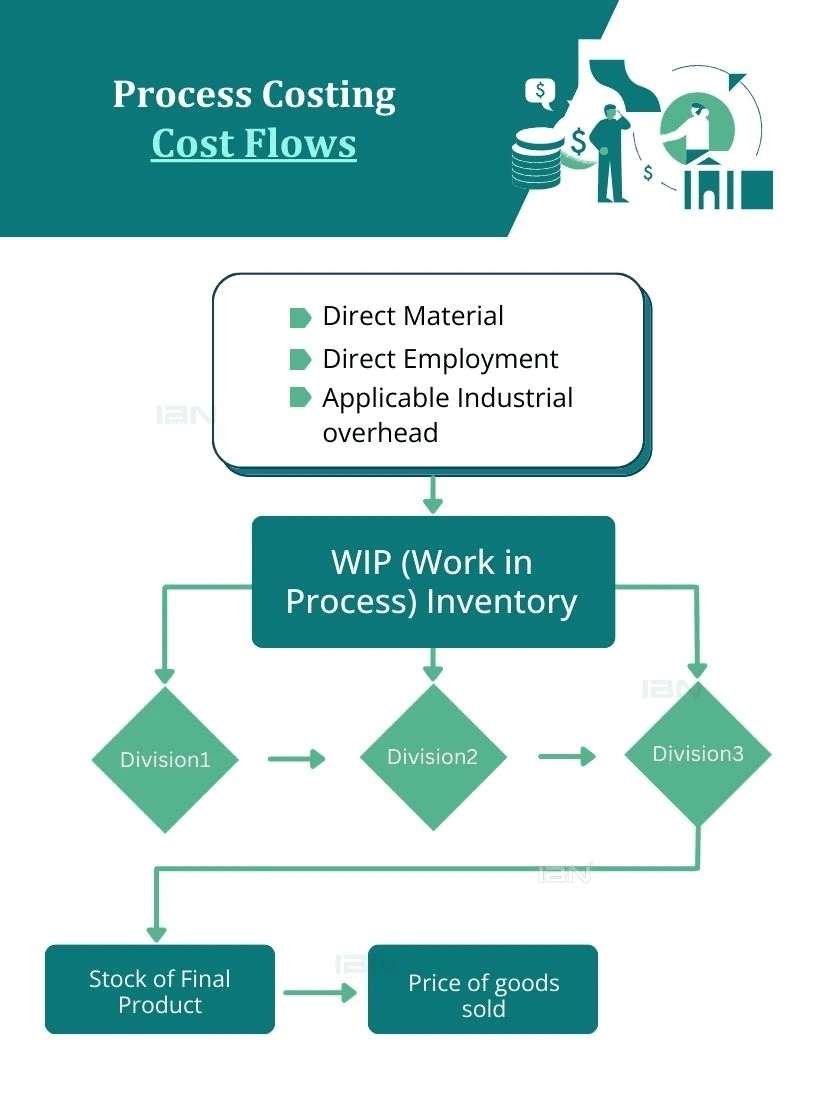

Tracing the Cost Flow in Process Costing

Within the framework of process costing, costs, including direct materials, labor, and overhead, are accrued at each production phase, providing a clear view of expenditure as products navigate through the manufacturing process.

Benefits of Process Costing

The benefits of process costing are integral for businesses, particularly in manufacturing, providing a spectrum of advantages that elevate operational efficiency and contribute to financial well-being. Some of these benefits include:

In-depth Financial Analysis

Helps in spotting cost trends, gauging production efficiency, and facilitating data-driven financial decisions.

Enhanced Cost Control

Accurate cost allocation helps pinpoint areas for cost savings, thereby boosting profitability.

Strategic Pricing

Aids manufacturers in pricing products competitively while ensuring profitability.

Regulatory Compliance

Simplifies the auditing process and ensures alignment with regulatory mandates.

Challenges of Process Costing

The challenges of process costing encompass:

1. Handling fluctuating variable costs.

2. Determining the most effective overhead allocation method.

3. Accurately tracking costs in complex, multi-process production systems.

Improve Efficiency in Process Costing with IBN Tech

With over two decades of expertise in online bookkeeping services for small businesses, IBN Tech offers more than just conventional accounting software. It provides comprehensive oversight of your sales cycle, from inception to completion, and adeptly manages your inventory. By automating and optimizing process costings functions, IBN Tech not only curtails expenses but also allows your team to concentrate on other vital business facets, ultimately saving both time and resources.

Conclusion

Process costing is more than just a technique; it functions as a valuable strategic tool, providing businesses with accurate cost data that can enhance profitability and competitiveness. It is essential for both large corporations and small businesses to consider adopting this approach to optimize costs, establish competitive pricing, and improve overall profitability.

Process Costing FAQs

- Q.1 What is process costing in cost accounting?

- Process costing, a term in cost accounting, defines a method for collecting and allocating manufacturing costs to produced units. It is employed in scenarios where identical units are mass-produced.

- Q.2 What is the primary purpose of process costing?

- Process costing and job costing are cost-determination methods. Let’s briefly differentiate job costing from process costing. Unlike traditional costing, process costing concentrates on the collective costs of a process rather than tracking costs for each individual item.

- Q.3 What is process costing in cost accounting?

- Process costing is a cost accounting method primarily used in manufacturing, especially in cases where units are continuously mass-produced through one or more sequential processes.

- Q.4 What is the difference between process costing and job costing?

- Process costing is used in mass production settings, while job costing is used in settings where unique products are produced on a job-by-job basis. In process costing, costs are allocated to units produced, while in job costing, costs are traced to individual jobs.