Tax deductions are vital for reducing a business’s taxable income and fostering growth by easing financial burdens. A small business tax deductions checklist is crucial for understanding these benefits and ensuring tax compliance. Effectively using these deductions can lower income tax bills, streamline the filing process, and reduce the overall tax owed to the government.

Table of Content –

1. What is a small business tax deduction?

2. Key Tax Deductions for Small Businesses

a. Operating Expenses

b. Employee-Related Expenses

c. Capital and Investment Expenses

d. Financial and Insurance Expenses

e. Tax-Specific Deductions and Credits

f. Trending Deductions

g. Maximizing Deductible Business Expenses

h. General Tax Strategies

3. Beyond Bookkeeping: Tax Services at IBN Tech

4. Tax deduction FAQs

What is a small business tax deduction?

Small business tax deductions, also known as tax write-offs, cover expenses essential for operating a business. By subtracting these from business income on tax returns, they reduce overall tax liability. The definition of these expenses is broad, allowing various costs to be deductible under certain conditions. However, many business owners don’t fully leverage these deductions, leading to unnecessarily high tax payments.

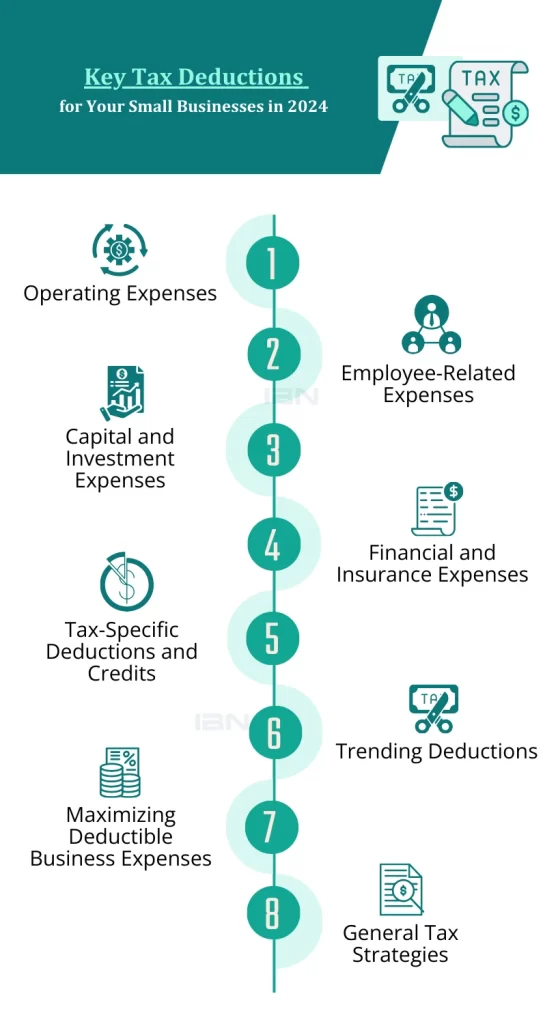

Key Tax Deductions for Small Businesses

Diverse and multifaceted, business tax deductions span a broad spectrum. From everyday operational expenses to more substantial capital investments, these deductions vary by industry and business structure. To avoid missing out on potential tax deductions, it is crucial to have a thorough understanding of these categories, as it plays a key role in maximizing tax efficiency.

Operating Expenses

- Business Meals and Entertainment:

- Business Meals Deductibility – Expenses for business meals are typically 50% deductible (100% in cases like business travel)

- Documentation: Essential to maintain receipts and notes for the business context.

- Advertising and Promotion: Costs related to advertising and promotion are deductible.

- Legal and Professional Fees: Fees paid for business-related legal and accounting services are deductible.

- Vehicle Usage: Costs for using personal vehicles for business or the standard mileage rate are deductible.

- Business Insurance Deduction: Various types of necessary business insurances are deductible.

Employee-Related Expenses

- Employee Salaries and Contract Labor: Payments to employees and contractors are tax-deductible. Proper documentation like W-4 and W-9 forms, and issuing 1099s for contractors, is crucial for legitimizing these deductions.

- Employee Benefit Programs: Expenses for benefits like health, educational assistance, FSAs, and achievement awards are deductible. There are also credits available for certain benefits like small business health care and retirement plans startup costs.

- People Costs: Includes payroll, employee benefits, taxes, and training and education expenses.

Capital and Investment Expenses

- Depreciation: Depreciation of assets like vehicles, equipment, and furniture can be deducted.

- Startup and Organizational Costs: Amortized capital expenses related to starting a business.

- Inventory Costs: Deductible cost of goods sold, including raw materials, storage, and direct labor costs.

- Research and Development (R&D) Tax Credit: Credit for qualifying research expenses for businesses engaged in innovation.

- Section 179 Deduction: Allows deducting the full cost of qualifying equipment and property in the year it was purchased, up to $1.16 million.

- Green Energy Usage: Deductions for eco-friendly solutions like solar panels or electric vehicles.

Financial and Insurance Expenses

- Health Insurance Premiums: Self-employed individuals can deduct 100% of their health insurance premiums, even if the plan includes family members.

- Interest on Loans: Deductible interest if the loan is used for business expenses.

- Debts and Bank Fees: Deductible fees associated with business bank accounts and loans.

Tax-Specific Deductions and Credits

- Qualified Business Income Deduction (QBI): Businesses can deduct up to 20% of their business income under QBI.

- Employee Retention Credit (ERC): A credit for wages paid to employees under certain conditions.

- Deduction for Home Office Expenses: Deductions for a portion of home-related costs for a home office.

- Exclusion for Qualified Small Business Stock (QSBS): Excludes a portion of the profit made from selling QSBS, reducing capital gains taxes.

- Educator Expenses Deduction: For educators, a deduction of up to $300 for classroom supplies.

- 401K and Traditional IRA Contributions: Contributions to retirement accounts are deductible, up to $76,000 for certain accounts.

- Health Savings Account (HSA): Contributions to HSAs are tax-deductible and can be used for various health expenses. This enables effective write-offs of health expenses.

Trending Deductions

- Startup Costs: Deductible expenses related to setting up a business.

- Bad Debts: Deductible if certain criteria are met, particularly relevant post-COVID.

- Net Operating Losses (NOLs): Allow businesses to carry forward losses to offset future profits.

- Fringe Benefits: Related to employee deductions, such as health insurance and retirement plans.

Maximizing Deductible Business Expenses

- Education Costs: Deductible if they add value and increase expertise in the business field.

- Home Office Expenses: Deductible if the space is used exclusively for business. Two methods for deduction: simplified and standard.

General Tax Strategies

- Impeccable Record-Keeping: Maintain accurate financial records and documentation.

- Stay Informed on Tax Law Changes: Keeping up-to-date with tax laws at federal, state, and local levels.

- Leverage Tax Credits: Exploring various tax credits available for different business activities and investments.

- Planning and Consulting: Regularly review financials with a tax professional for potential deductions and tax planning opportunities.

Beyond Bookkeeping: Tax Services at IBN Tech

IBN Tech is committed to empowering small businesses by expertly navigating the complexities of tax deductions. Our skilled team of bookkeepers meticulously records every business expense, ensuring you capitalize on every tax deduction opportunity. This precision not only builds your confidence but also equips you to face any IRS scrutiny with ease.

But our services extend beyond just bookkeeping. As the year ends, you can opt to furnish your year-end accounting records to your accountant or authorize us to handle the tax preparation on your behalf. As a result of choosing us for your tax needs, you can concentrate on running your business, knowing that your tax deductions are being optimized.

Understanding what expenses qualify as tax deductions for small businesses and how these deductions work is crucial for financial efficiency. By identifying and utilizing every eligible deduction, we simplify the financial management process. This approach not only eases tax season stress but also promotes a more cost-effective strategy for managing your business finances.

At IBN Tech, we understand the significance of recognizing eligible tax deductions for small businesses and implementing them effectively for financial efficiency. Our approach simplifies your financial management, reduces tax season stress, and fosters a cost-effective strategy for your business’s financial health.

Choose IBN Tech for peace of mind in maximizing your tax deductions and streamlining your financial management—where your business’s financial well-being is our top priority.

(It’s important to keep good records, such as receipts, invoices, and bank statements, so you can prove your tax deductions. It’s a smart move to talk to a tax professional or a CPA to make sure you’re doing things right and getting all the tax breaks you can for your small business.

Just remember, this list is just to give you an idea and isn’t meant to be actual tax advice. Every business is a little different, so keep that in mind.

Tax deduction FAQs

- Q.1 What are small business tax deductions?

- These are expenses that can be subtracted from a small business’s income to reduce its taxable income, such as advertising costs, insurance premiums, and professional fees.

- Q.2 What expenses are tax deductions for small business?

- Deductible expenses include rent, utilities, office supplies, marketing, travel, legal and accounting fees, and employee benefits.

- Q.3 How do tax deductions work for small businesses?

- Tax deductions lower the total taxable income of a business. Eligible expenses incurred in the operation of the business are subtracted from the gross income to determine the taxable income.