The accounts receivable procedure is one of the most crucial components of every profitable organization. The viability of any organization is determined by its capacity to earn revenue and pay its debts.

The full lifecycle of asking and receiving payments from clients is referred to as account receivables management. You need an effective and efficient accounts receivable system to prevent cash flow issues. You will learn about the common problem of AR and how to manage it effectively. You will also examine the goals of AR management and techniques for tackling it.

Accounts in Receivable and management

Accounts receivable are invoices that a business is due from customers for goods or services that have been delivered but have not yet been paid for. The accounting process depends heavily on accounts receivable. Find AR details on The Impact Of Accounts Receivable Management On Financial Success. While receivables management is the process of managing and collecting payments from customers.

Reasons Why Receivables Management Is Important

A company’s cash flow and many other factors are impacted by effective AR management. It should therefore always receive the attention it deserves.

You face the risk of not having enough cash on hand to cover crucial activities like salaries, purchases, and dividends if your company is not managing its collections efficiently and there is a widespread and ongoing issue with payments in arrears.

Maintaining positive client relations and enhancing your company’s reputation are both benefits of effective AR management. Poor customer service may make it more difficult for your business to retain customers and negotiate favourable terms in the future.

Finally, the effectiveness of your accounts receivable program may have an impact on how you interact with investors and how well you can expand. Your financial sheet and profit margin are both impacted by cash flow. In order to determine whether your company has strong balance sheets, investors and lenders will check to see if your accounts receivable procedure is efficient and that you have a successful track record of collecting money.

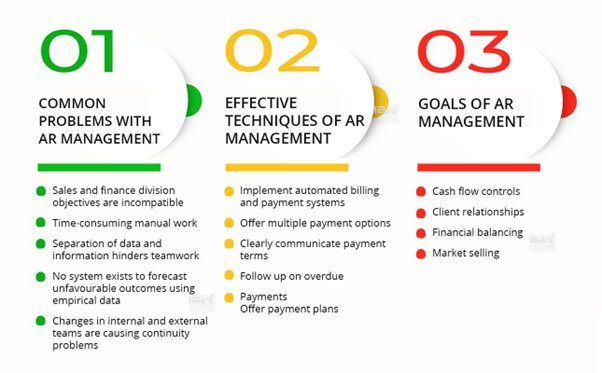

What common problems with accounts receivable management are there?

Common problems that have an impact on accounts receivable include:

The objectives of the sales and finance divisions are incompatible.

Conflicts will occur because the finance team wants to eliminate bad debts, whilst the sales team wants to increase sales. Customers may be given credit conditions by the sales team, but the finance department may not agree with them.

There are numerous gaps in the process that call for time-consuming manual work.

Without automating your accounts receivable operations, your staff will inevitably spend the bulk of their time performing manual tasks, which will lead to subpar AR management.

Teamwork is made difficult by the separation of data and information.

If you don’t have real-time access to data, your company may struggle with a lack of coordination between teams that interact with customers, such as sales, collections, and other departments.

No system exists to forecast unfavorable outcomes using empirical data

It is impossible to foresee when an account may go bad without access to past data, and this can result in significant losses if the consumer is unable to pay.

Changes in internal and external teams are causing continuity problems.

Credit transactions necessitate ongoing billing documents and payment streams. The invoicing-collections-payment-cash application procedures will break down if your accounts receivable management is not streamlined.

This could harm the company’s reputation, result in expensive legal action, and possibly even cause financial troubles and collapse. Due to all of this, effective methods for controlling and collecting customer payments are crucial for organizations for a number of reasons.

Effective Techniques for Managing and Collecting Customer Payments

There are several techniques that businesses can use to improve their accounts receivable management. Let’s discuss one by one.

1.Implement automated billing and payment systems:

Automated billing and payment systems can help streamline the invoicing and payment process, reducing the amount of time and effort required to manage accounts receivable.

2.Offer multiple payment options:

Automated billing and payment systems can help streamline the invoicing and payment process, reducing the amount of time and effort required to manage accounts receivable.

3.Clearly communicate payment terms:

It is important for businesses to clearly communicate their payment terms to customers, including the due date and any late payment fees. This can help avoid misunderstandings and encourage timely payment.

4.Follow up on overdue payments:

If a customer does not pay by the agreed-upon date, it is important for businesses to follow up in a professional and timely manner. This might involve sending reminder emails or letters, making phone calls, or using a collection agency.

5.Offer payment plans:

For customers who may have difficulty paying in full, businesses can consider offering payment plans to help them manage their debts.

What are the goals of managing accounts receivable?

In any organization, there are always key goals that management strives to achieve. While these goals may vary from company to company, there are some commonalities that are typically seen. These goals usually revolve around financial performance, growth, customer satisfaction, and employee satisfaction. Achieving these goals can provide a number of benefits to the organization, including increased profits, market share, and employee morale. Many aspects of the business are impacted by how you manage your accounts receivable. These consist of:

1.Cash flow controls

Your cash flow is directly impacted by the pace at which you are able to collect receivables from your clients. Your cash flow suffers when receivables start to move slowly.

2.Client relationships

The way your consumers see you are directly influenced by how you manage your accounts receivable. For instance, it would irritate a customer if your AR staff contacted them repeatedly even after payment has been received. A negative factor can also arise if you anticipate receiving payments from clients despite failing to timely send bills to them.

3.Financial balancing

Your AR team’s time is frequently largely consumed by going through the incoming payments and applying them to the appropriate accounts. It can be a tedious and inaccurate procedure to do this without a solid framework in place.

4.Market selling

A domino effect is unavoidable when your staff is unable to control your cash flow, enable positive customer encounters, and spend the majority of their time on cash application. Poor cash flow makes it difficult for you to pay your suppliers, which interferes with your capacity to offer the goods or services as promised and can harm your reputation.

Overall receivables management is essential for businesses because it allows them to track client payments, manage customer accounts, and follow up on past-due receivables. Furthermore, receivables management can assist organizations in improving their cash flow and reducing the number of write-offs they incur.

With effective techniques for managing and key goals of AR management, businesses can improve efficiency and effectiveness, maximize their payment and collection processes, and achieve financial stability and success by controlling cash flow management, client relationships, financial balancing, and market selling.

Conclusion

Outsourcing accounts receivable also makes it more easily to establish communication across your teams in order to keep everyone up to date on their clients. Keep in mind that if you think that outsourcing your AR management IBN tech will solve the issue. IBN tech is a well-known industry-recognized best outsourced accounting service that assists with all areas of accounting.