Are you feeling overwhelmed by the bookkeeping tasks that come with running your business?

You’re not alone— many business owners, CEOs, or founders lack confidence when it comes to accounting and finance.

The good news is, bookkeeping firms offer solutions to these challenges, bringing the necessary expertise and skills in accounting and bookkeeping.

Outsourcing your bookkeeping can be an effective way for business founders or CEOs to free up time and resources to focus on the bigger picture.

Table of Contents

- What are Outsourced bookkeeping services?

- Why should you Outsource your bookkeeping services?

- When should you outsource your bookkeeping services?

- What is the price of Outsourcing bookkeeping services?

- Difference between the cost of outsourcing and the cost of in-house outsourcing

- How do I begin outsourcing my bookkeeping?

- Tips for effective Outsourced bookkeeping services

- Conclusion

- Outsource bookkeeping cost FAQ’s

What are Outsourced bookkeeping services?

Outsourcing bookkeeping services involves hiring a third-party provider to handle financial tasks. This not only ensures accurate financial records but also offers several other advantages, such as cost savings and professional expertise, which we’ll explore further. With these responsibilities offloaded to professionals, outsourcing bookkeeping offers a range of advantages for business owners.

Why should you Outsource your bookkeeping services?

Outsourcing bookkeeping is an excellent way to reduce your tax burden while allowing you to concentrate on other essential tasks. By outsourcing your bookkeeping services, you can scale your business more efficiently and gain access to advanced, specialized accounting systems. Here are some of the reasons why you should outsource your bookkeeping services:

- Financial efficiency: Hiring a full-time in-house bookkeeper can be expensive, especially for small businesses. Outsourcing allows you to pay only for the services you need, reducing the cost of overhead expenses.

- Professional precision: Professional bookkeeping firms employ skilled accountants who stay up to date with the latest financial regulations and best practices, ensuring your books are accurate and compliant.

- Data-driven decision making: Professional bookkeepers can provide detailed financial reports and analyses, helping you make informed business decisions.

- Cutting-edge tools: Many bookkeeping firms use sophisticated accounting software for small businesses that might be too expensive to purchase and maintain on their own.

- Punctual financial management: Outsourced bookkeepers can ensure that your financial statements and reports are prepared and delivered on schedule, which is crucial for tax compliance and business planning.

- Resource optimization: Delegating bookkeeping tasks frees up valuable time for you and your team to focus on core business activities and growth strategies.

- Stress reduction: Knowing that your financial records are being handled by professionals can reduce stress and allow you to focus on running and growing your business.

While the benefits are clear, it’s important to recognize the signs that indicate it’s time to make the switch to outsourcing.

When should you Outsource your bookkeeping services?

When starting a business, it’s common to want to handle as many tasks as possible on your own. However, as your business expands, it’s crucial to concentrate on your core strengths and delegate other tasks by outsourcing, allowing you to save time and resources.

Bookkeeping is one area where outsourcing can be particularly beneficial. Here are some signs that indicate it might be time to outsource your bookkeeping services:

- Your business is growing rapidly: As your company expands, financial transactions become more complex and time-consuming. Outsourcing can help you keep up with this growth.

- You’re spending too much time on bookkeeping: If bookkeeping tasks are taking you away from core business activities, it’s time to consider outsourcing.

- You lack expertise in accounting: Bookkeeping requires specific knowledge and skills. If you’re not confident in your ability to manage finances accurately, outsourcing to experts can prevent costly mistakes.

- You want to improve financial reporting: Outsourced bookkeepers can provide more detailed and accurate financial reports, which can be crucial for decision-making and attracting investors.

Along with knowing when to outsource, it’s equally important to consider the costs involved in outsourcing your bookkeeping service.

What is the price of outsourcing bookkeeping services?

There is no fixed answer to the cost of outsourcing bookkeeping, as it varies based on the specific needs of your business. However, the most apparent cost is the fee you pay for the service. While outsourcing bookkeeping has many benefits, it’s essential to understand the potential costs before making the switch. Gaining an understanding of these expenses will help you make an informed decision.

Several factors influence the total price, including the size and type of your business. Larger businesses with more employees and complex accounting needs will likely face higher outsourcing costs compared to smaller businesses that mainly require bookkeeping and tax preparation services.

Another key factor affecting the cost is the qualifications and experience of the accountant or bookkeeper. A seasoned professional with expertise in your industry will typically charge more than someone with less experience. Ultimately, the cost of outsourcing bookkeeping depends on the specific needs of your business, including the volume and complexity of transactions.

For businesses seeking cost-effective bookkeeping services, IBN Technologies offers customized packages for bookkeeping that vary from Per Hour. Following infographics image gives an overview of Dedicated, Part time and Quarter Time Rates of company.

Affordable Bookkeeping Solutions by IBN Technologies

We also provide other services like finance and accounting services, payroll processing, AP/AR automation, tax support and other industry specialized services.

Difference between the cost of Outsourcing and the cost of in-house Outsourcing

- The Cost of Outsourcing Bookkeeping

When you outsource your bookkeeping, you’re paying an external professional—either a qualified accountant or an experienced bookkeeper—to manage your financial records. This option can be more affordable than employing a full-time accountant, especially if you don’t require all the services that an in-house accountant typically offers.

- The Cost of Hiring an In-House Accountant

Hiring an in-house accountant tends to be more expensive than outsourcing. Beyond salary, you’ll need to factor in additional expenses such as an annual retainer fee, which may be tax-deductible, office space, and related overhead costs. You’ll also need to account for the accountant’s salary, bonuses, and other benefits.

When comparing the cost of outsourced bookkeeping versus hiring an in-house accountant, outsourcing generally proves to be the more economical option.

Once you’ve weighed the costs and benefits, the next step is to understand how to begin outsourcing your bookkeeping tasks.

How do I begin outsourcing my bookkeeping?

Many small businesses opt to outsource their bookkeeping to free up time and resources for other priorities. To get started, follow these key steps:

- Identify your needs. Determine which specific tasks you want an external accountant to handle and set a budget for each task.

- Find a trusted accountant. Establish a working relationship with an accountant or bookkeeper you’re comfortable collaborating with.

- Research outsourcing options. Explore the various bookkeeping services available and take time to research reputable providers before making a choice.

- Plan and implement the outsourcing process. Set up a contract with the chosen firm, ensure all necessary documentation is submitted on time, and monitor the project’s progress to ensure satisfaction with the results.

- Review and adjust as needed. Since bookkeeping can be complex, remain adaptable and stay updated on market changes to keep your business competitive.

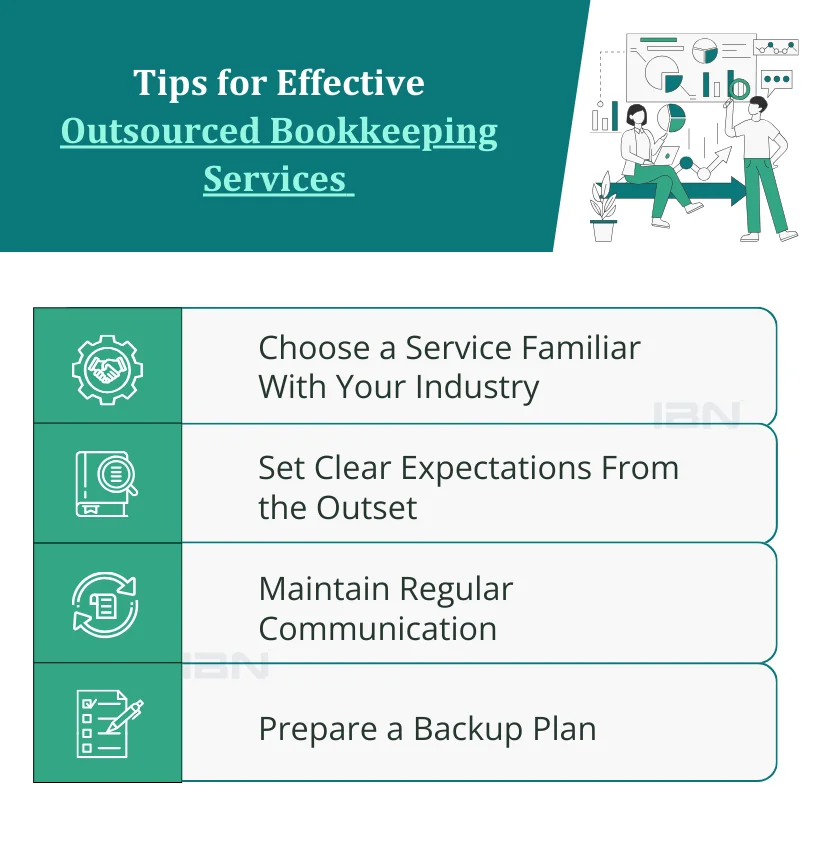

Tips for Effective Outsourced bookkeeping services

Now that you understand what to look for in a bookkeeping service and the associated costs and benefits, here are some tips to ensure you get the most out of your outsourcing decision:

- Choose a service familiar with your industry. Opt for a bookkeeping service that has experience with businesses in your field.

- Set clear expectations from the outset. Clearly define what you expect from the bookkeeping service to avoid miscommunications and ensure that expectations are managed effectively.

3.Maintain regular communication. Stay in frequent contact with your bookkeeping service to stay informed about your finances and ensure alignment.

4. Prepare a backup plan. Have a contingency plan in place for your bookkeeping services to address any potential issues or emergencies, ensuring you remain prepared for unexpected situations.

Conclusion

According to bookkeeping experts at IBN Tech, managing bookkeeping can be overwhelming, especially for new entrepreneurs. While some business owners prefer to handle bookkeeping themselves, outsourcing these services can be a valuable way to free up time and focus on other critical areas of your business.

When outsourcing your bookkeeping, it’s crucial to select the right service for your company and establish clear expectations from the beginning. By following these steps, you can ensure that outsourcing your bookkeeping becomes a beneficial rather than a burdensome choice for your business.

Outsource Bookkeeping Cost FAQ’s

1. How does the cost of outsourcing bookkeeping compare to hiring an in-house accountant?

Bookkeeping Outsourcing is generally more cost-effective than hiring an in-house accountant. In-house accountants require a salary, benefits, office space, and additional overhead costs, whereas outsourcing allows you to pay only for the services you need, often at a lower overall cost.

2. Can outsourcing bookkeeping services improve my financial reporting?

Yes, professional bookkeepers can provide detailed and accurate financial reports, which are crucial for informed decision-making, strategic planning, and attracting investors. Outsourcing can also help ensure compliance with financial regulations.

3. How do I begin the process of outsourcing my bookkeeping?

Start by identifying your specific needs and setting a budget. Research potential providers, establish a working relationship with a trusted accountant or bookkeeper, and set up a contract. Ensure all necessary documentation is submitted on time and monitor the progress.