There are three primary financial statements:

The profit and loss statement

The profit and loss statement

The companies release these reports statements quarterly or yearly.

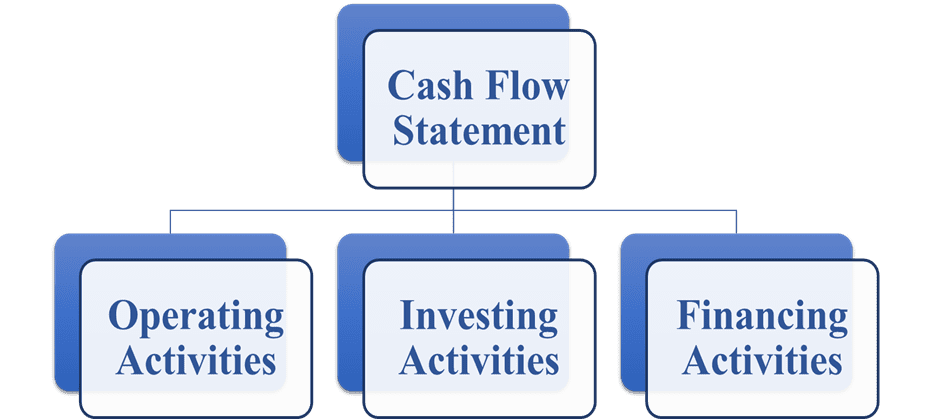

A cash flow statement gives the details of the business’s cash inflows and cash outflows in a financial year.

It helps investors understand the sources of cash inflows and outflows, which helps them analyze the performance and liquidity of the business.

So, get an insight into cash flow statements, their analysis, and the importance of cash flow statements.

According to C2FO’s Working Capital Survey in 2022, almost 22% of the businesses said that they faced a lack of access to funding in 2021, out of which 30% claimed that the reason for that was poor cash flow which shows that the analysis of cash flows is very important for the investors.

Meaning of Cash Flow Statement

The cash flow statement is a statement that provides the details of the net cash flow (cash and cash equivalents) from the business, which is calculated using the total cash outflows minus the total cash inflows in a specified period. It assists stakeholders in determining where the company’s money is being spent and what the company’s sources of income are.

The cash flow statement includes the three activities undertaken by a business.

1.Cash Flows from Operating Activities

The activities included in this section are related to the business’s core operations where expenses are incurred and generate income. The cash inflows and cash outflows activities are accounts receivable, accounts payable, inventory purchase and sale, interest and income tax payments, salary to employees, rent payments, etc.

Investors should analyze this section because it helps them see from which activities the company is getting the cash from its operations and the overhead activities on which the company is spending its cash. As it does not include the non-cash expenses, it gives a true picture of the business.

The two ways to calculate the operating cash flow in cash flow statements are a direct method and an indirect method.

-

- Direct Method

This method is used on the basis of actual cash flows from the business, such as cash receipts from customers and debtors, cash payments to suppliers, cash expenses in business operations, cash interest payments paid to creditors, and taxes paid to the government. All these inflows and outflows are added and deducted to arrive at the net cash flows from operating activities in a financial year.

-

- Indirect Method

In this method, the cash flow from operating activities is calculated using the basis of adjusting it against the net profit or loss in a financial year. Direct cash payments and receipts are not used in this method rather change in current assets and liabilities, depreciation, and amortization are added back, and change in working capital, changes in provisions, increase or decrease in accounts receivables and payables, etc. is adjusted.

2.Cash Flows from Investing Activities

This section includes the activities related to the capital expenditure, which include the purchase of assets such as land, property, equipment and machinery, expansion activities, investments in stocks of another company, acquisition of another company, etc., which leads to the outflow of cash and the divestment in the assets, sale of subsidiaries and stocks of another company that leads to the inflow of cash.

The investor can analyze this section and know whether it’s a growing company or not because, generally, a growing company has negative net cash flow from financing activities. An established company will have positive net cash flow from investing activities because it is not spending more on the purchase of assets and related activities.

3.Cash Flows from Financing Activities

The activities related to the financing activities are included in this section, which can be receipts from stock sales, receipts of loans, borrowed funds, etc. in cash inflows.

Dividend payments, loan repayments, buyback of shares, etc. are treated as cash outflows in financing activities.

Investors can analyze this section to learn how much cash the company is getting from its equity and debt sources. If the company is financing more from debt sources, then there might be a bankruptcy situation.

7 Importance of Cash Flow Statement to Shareholders or Investors

Then comes the detailed question, why is a cash flow statement important, and why cash flow analysis is so important for investors?

All the shareholders want to get their dividends on time, which is checked from the cash flow statement to see if they have enough liquidity or not.

All the investors or creditors of the company also want their interest payment on time.

1.Analysis of historical cash flows

It helps the investors analyze the historical cash flows from all the activities and gives a more holistic approach to analyzing them. As a result, it is also used to calculate projected cash flows.

2.Analysis of changes in assets and liabilities

From investing and financing activities, an investor can see the changes in assets and liabilities and how they are financed.

3.To check the liquidity

An investor can easily check for liquidity by seeing the operating cash flow or net cash flow for a specified period.

4.Check the financial position

An investor can also analyze the financial position of the company based on all the activities that a business is undertaking in a financial year.

Importance of cash flow statement to shareholders or investors

5.Income-generating sources

By analyzing the operating cash flow section of the cash flow statement, an investor can check the sources from which companies are generating income.

6.Compare different companies

Investors can also compare different companies based on the way they are financing the business to know the quality of the earnings.

7.Real valuation

It also helps the investors to know the real valuation of the business, which can be calculated using free cash flow and further discounted to get the DCF valuation results. It helps to know the real or intrinsic value of a stock in a company.

Analysis of Cash Flow Statement by Shareholders

After knowing why the cash flow statement is important for investors, the pointers to analyze are-

1.The operating cash flows are the sources that are related to the core operations of a business and therefore they are called the “heart” or considered to be the most important section of the cash flow statement. High net cash flow operating activities indicate higher liquidity.

2.Net cash flows from investing and financing activities are generally negative because businesses constantly invest in new assets for expansion or pay down debt or distribute dividends to shareholders.

3.In the long run, the net cash flow from operating activities should equal the total net cash flow from investing and financing activities.

4.If the company is selling its assets to finance its business, then it might be an alarming situation. In this scenario, there will be positive cash flow from a financing activity and low operating cash flows.

5.The positive net cash flow indicates a healthy situation, with the company having higher liquidity and expansion possibilities. The negative net cash means that outflows are greater than inflows, which needs to be properly analyzed but might be the decision to expand the business, which later leads to higher profits.

Ratio Analysis

Knowing the importance of cash flow statements is not enough, but analysis using ratios can be of utmost importance too.

| Ratios | Explanation | Formula |

|---|---|---|

| Cash Flow Coverage | This ratio helps in analyzing the solvency of the company because it means that the company can pay its long-term debts. The ideal ratio is greater than 1 which means that the company’s cash flow from operations will pay its debt. | Net cash flow from operations / Total debt |

| Cash Flow Margin | This is the profitability ratio which means that the business’s cash flow from operations is a percentage of revenue from operations. It indicates how sales are converted as a percentage of cash. | (Net income + Non-cash expenses + Change in working capital) / Sales |

| Current Liability Coverage | This ratio helps in analyzing the liquidity of the company because it means that the company can pay its short-term debts having a tenure of less than 1 year. | (Net cash flow from operating activities – Cash dividends) / Average current liabilities |

| Price to Cash Flow | This profitability ratio helps in analyzing the investors giving a rupee investment as compared to the cash flow generated from the operations. | Market capitalization/ Net cash flow from operating activities |

| Cash Interest Coverage | This ratio helps the investors to analyze whether a company is able to pay its interest on debt liabilities or not. The ideal ratio is greater than 1 which means that they are able to pay its interest liabilities on all debts. | (EBIT + Non-cash expense)/ Interest expense |

Outsource cash flow management work

The answer to the question of why a cash flow statement is important is very much clear to investors or shareholders and should make their decisions on that basis on giving a loan or investing in shares or debentures.

So, the company must provide the proper presentation of cash flow statements in order to give their prospective investors a clear point of view.

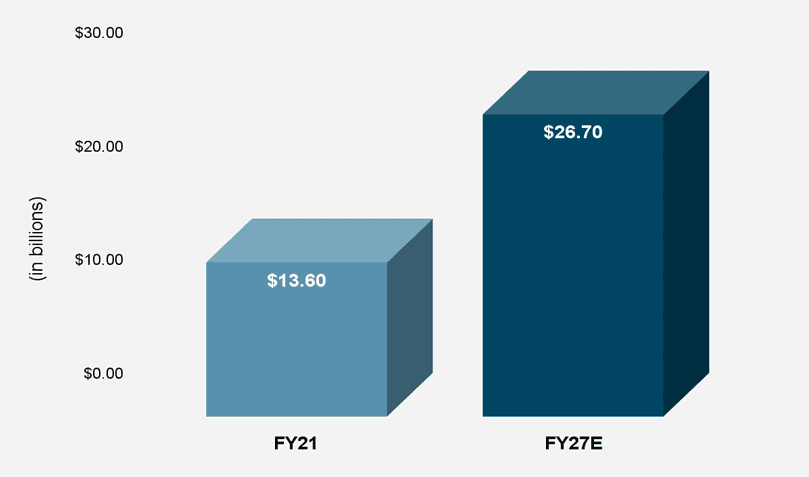

As per the latest Cash Management System Market Report, the Cash Management System market size in FY 2021 was valued at $13.60 billion, with an expectation to grow at a CAGR of 11.9% to $26.70 billion by FY 2027. It helps businesses to avoid cash flow mistakes and helps in managing their liquidity, record, and reconciliation of cash inflows and outflows.

The Cash Management System is expected to grow at a CAGR of 11.9% by FY27.

This work can be easily done by outsourcing accounting and bookkeeping services to a firm with multiple professionals, such as CAs, CFOs, and CPAs, to handle it more professionally while also suggesting ways for the company to improve its cash flows at a minimal cost.

Contact IBN Technologies:

With the help of IBN Technologies Limited, a company can easily present its cash flow analysis in a more professional way to investors, shareholders, or bankers.

FAQs

- 1.Why is a cash flow statement important to shareholders?

- The cash flow statement is important for the shareholders because it helps them analyze the historical cash flows and make future projections. It also helps in finding the real value of a stock.

- 2.Which financial statement is most important to shareholders?

- The financial statement that is most important to the shareholders is the cash flow statement, followed by the income statement to analyze the complete business.

- 3.What does the statement of cash flows show the stakeholders?

- It shows the liquidity and solvency of the business to the shareholders by showing the total cash inflows and outflows in all the activities.