Creating a cash flow forecast is normally the duty of a company’s finance department. However, forecasting cash flow requires input from various stakeholders and data sources, particularly in large enterprises.

Table of Contents

- What is Cash Flow Forecasting

- Why is Accuracy Essential in it?

- Challenges in Cash Flow Forecasting

- Strategies to improve Accuracy

- How IBN Technologies can help you with forecasting of Cash Flow

- Cash Flow Forecasting FAQ’s

What is Cash Flow Forecasting?

Cash flow forecasting involves predicting a business’s cash inflows and outflows over a specified period. Accurate cash flow forecast enables companies to anticipate future cash positions, avoid cash shortages, and maximize returns on any cash surpluses.

Why is Accuracy Essential in it?

Maintaining a stable cash flow is vital for any business, particularly for unprofitable SaaS companies focused on growth. Let’s explore why accuracy is important in it.

1. Encourages a Proactive Approach

An accurate cash flow forecast helps businesses understand the impact of key decisions. It identifies red flags like negative balances, enabling timely corrective actions. With a clear view of revenue and expenses, companies can plan for short-term financing needs and investment requirements. Accurate forecasting answers critical questions, such as:

- How much can be spent on marketing and operations?

- Is it feasible to hire more staff?

- Can discounts be offered at a higher rate?

2. Provides Insight into Burn Rate

Understanding your burn rate through accurate forecasting helps gauge how long your cash will last and what measures are needed to extend your runway. For startups or growing companies, this is especially important when future funding is uncertain. Forecasting also informs whether additional investment is needed.

3. Builds Investor Confidence

Accurate cash forecasts and regular updates boost investor and lender trust, leading to better investment or loan terms. Demonstrating the ability to predict cash burn and investment timelines increases investor confidence in your management, making future investments more likely.

4. Enables Spending Prioritization

In situations with limited cash or a high burn rate, accurate forecasting helps prioritize which creditors to pay first. Poor forecasting can result in paying lower-priority creditors, risking cash shortages and potential funding cut-offs. It also aids in managing payments to minimize interest while maintaining liquidity.

5. Supports Working Capital Management

Accurate forecast of cash flow reveals the impact of working capital on cash position, helping decide whether to reduce it. Lower working capital reduces cash needs, allowing for a lower balance or delayed investment efforts.

Challenges in Cash Flow Forecasting

- Data Quality and Consistency: Accurate forecasting relies heavily on high-quality, consistent data. Many businesses struggle with siloed information across departments, inconsistent reporting practices, or outdated systems. This can lead to incomplete or conflicting data, making it difficult to create a reliable forecast.

- Unexpected Events: Economic downturns, natural disasters, sudden market shifts, or global events like pandemics can dramatically impact cash flow. These unpredictable factors are inherently difficult to account for in forecasts, yet they can have significant consequences on a company’s financial health.

- Seasonality and Market Fluctuations: Many businesses experience cyclical patterns in their cash flow due to seasonal demand or industry-specific trends. Accurately predicting these patterns, especially when they’re subject to change due to evolving market conditions, can be challenging. Furthermore, market volatility can make it difficult to forecast revenue and expenses accurately.

- Time Horizon: Short-term forecasts (e.g., 30-90 days) are typically more accurate but may not provide enough insight for long-term planning. Conversely, long-term forecasts are crucial for strategic decision-making but are inherently less accurate due to increased uncertainty over time. Balancing these needs can be challenging.

- Complex Business Structures: For large corporations, especially those with international operations, forecasting becomes exponentially more complex. Different currencies, tax regimes, and business practices across various entities or countries can make it difficult to consolidate and accurately predict cash flow.

To overcome these challenges, businesses can adopt the following strategies to improve their accuracy.

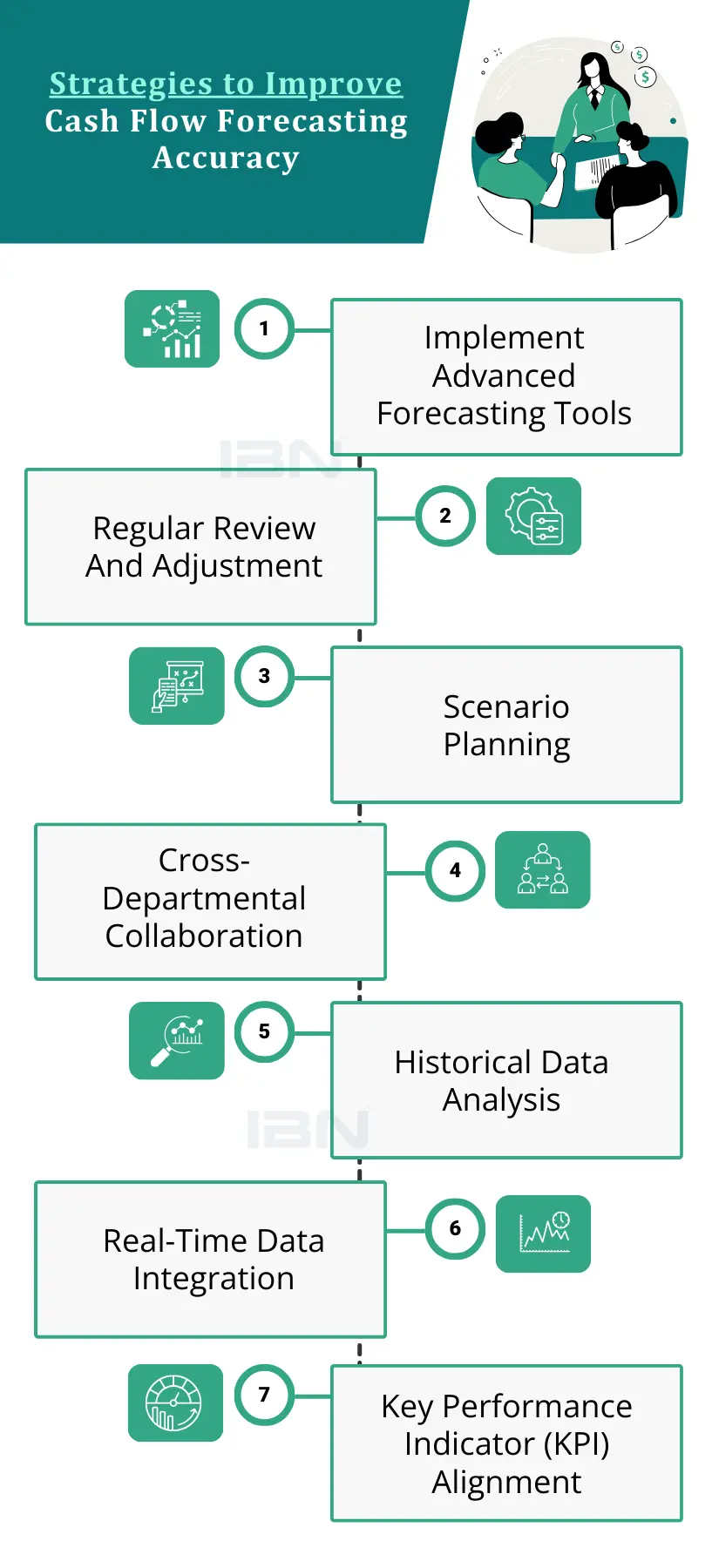

Strategies to Improve Accuracy

- Implement Advanced Forecasting Tools: Leveraging AI and machine learning technologies can significantly improve forecast accuracy. These tools can analyze vast amounts of data, identify patterns, and make predictions more accurately than traditional methods. They can also adapt to changing conditions more quickly, improving forecast reliability.

- Regular Review and Adjustment: Implement a process of continuous comparison between forecasts and actual results. This allows you to identify discrepancies, understand their causes, and refine your forecasting models accordingly. Regular reviews also help in spotting trends or changes in business patterns early.

- Scenario Planning: Develop multiple forecast scenarios based on different potential outcomes. This might include best-case, worst-case, and most-likely scenarios. Scenario planning helps prepare for various possibilities and makes the organization more adaptable to change.

- Cross-Departmental Collaboration: Involve all relevant departments in the forecasting process. Sales can provide insights on pipeline and expected closings, operations can inform about upcoming expenses or efficiency improvements, and HR can advise on personnel changes. This collaborative approach provides a more comprehensive and accurate forecast.

- Historical Data Analysis: Utilize past performance data to inform future predictions. Look for patterns, trends, and correlations in historical data that can help improve forecast accuracy. However, be cautious about over-relying on historical data, especially in rapidly changing environments.

- Real-Time Data Integration: Incorporate real-time financial data into your forecasting process. This can include up-to-the-minute sales data, current market conditions, and recent expense information. Real-time data integration allows for more dynamic and responsive forecasting.

- Key Performance Indicator (KPI) Alignment: Ensure your cash flow forecasts are aligned with other important business KPIs. This might include sales targets, production metrics, or customer acquisition costs. Aligning forecasts with KPIs provides a more holistic view of the business and can improve overall accuracy.

How IBN Technologies Can Help with Forecasting of Cash Flow

IBN Technologies offers comprehensive financial services that can significantly enhance your cash flow accuracy. Here’s how we can support your business:

- Advanced Forecasting Tools: We leverage cutting-edge AI and machine learning tools to enhance the accuracy of your cash flow forecasts. Our technology can analyze large datasets, detect patterns, and provide predictions that adapt to real-time changes in your business environment.

- Cross-Departmental Collaboration: Our team works closely with all relevant stakeholders in your organization, from sales and operations to HR and finance. We facilitate collaboration to ensure that all critical data points are considered, leading to more accurate and comprehensive forecasts.

- Scenario Planning & Regular Adjustments: At IBN, we don’t just help you create a forecast; we also support continuous monitoring and adjustment. We implement scenario planning to prepare your business for various potential outcomes, and we regularly review and refine forecasts based on actual results and evolving business conditions.

- Historical Data Analysis: With our expertise, we assist in analyzing historical data to identify trends and correlations that can inform future forecasts. This helps you make more informed decisions while being cautious of over-reliance on past data, especially in volatile markets.

- KPI Alignment: We ensure that your cash flow forecasts are aligned with your business’s key performance indicators (KPIs). By linking forecasts to sales targets, production goals, and other critical metrics, we provide a holistic view that enhances overall financial planning and accuracy.

- Expert Guidance and Support: Our team of finance professionals brings years of experience to the table. We offer expert guidance to help you navigate the complexities of cash flow forecasting, especially in challenging environments such as those faced by large enterprises or multinational corporations.

By partnering with IBN Technologies, you can improve the accuracy of your cash flow forecasts, better manage your working capital, and ensure that your business remains financially stable and ready for growth.

Cash Flow Forecasting FAQ’s

1. What are the three main causes of cash flow problems?

The three main causes of cash flow problems are poor cash flow management, such as delayed invoicing or not tracking expenses, overestimating revenue or underestimating costs, leading to cash shortages, and unexpected expenses or economic downturns that disrupt planned cash flows.

2. How do you calculate cash flow forecast?

To calculate a cash flow forecast, start by estimating future cash inflows (e.g., sales, loans) and outflows (e.g., expenses, debt payments) over a specific period. Subtract the total outflows from the total inflows for each period to determine the net cash flow. Regularly update the forecast with actual data to maintain accuracy.

3. What is importance of cash flow forecast in business?

A cash flow forecast is crucial for businesses as it helps predict future financial needs, ensures liquidity to cover expenses, aids in planning for growth or investments, and prevents cash shortages that could disrupt operations. It also supports informed decision-making and helps manage financial risks effectively.