Managing your finances effectively is essential for any small business. An accurate understanding of your cash flow is critical for making sound financial decisions and ensuring the long-term health of your company. Bank reconciliations are a fundamental tool that can help small businesses achieve this goal.

Table of Contents

- What is Bank Reconciliation?

- Purpose of Bank Reconciliation

- Why is Bank Reconciliation Important?

- Challenges With Bank Reconciliations

- How to Do Bank Reconciliations Step by Step

- Benefits of Bank Reconciliation

- Simplify Bank Reconciliations with IBN Technologies

- Bank Reconciliation FAQs

What is Bank Reconciliation?

In a nutshell, bank reconciliation is the process of comparing your business’s financial records to your bank statements. It’s like balancing your checkbook, but for your business accounts. The goal is to identify any discrepancies between the two sets of records and ensure that your financial picture is accurate.

Purpose of Bank Reconciliation

Bank statements are reliable and accurate financial records. By cross-checking your books with these statements, you can achieve several crucial benefits:

- Identify and Correct Errors: Detect and rectify any bookkeeping mistakes promptly, ensuring the accuracy of your financial records.

- Detect Unauthorized Payments and Fraud: Reviewing expenses helps you identify incorrect payments and suspicious activities, safeguarding your business against fraud.

- Gain Accurate Financial Insight: Regularly verified numbers provide a clear and accurate picture of your business’s financial performance, eliminating guesswork.

- Maximize Tax Deductions: During the reconciliation process, classify tax-deductible expenses to ensure you get the maximum tax benefits.

- Prepare for Tax Filing: Maintain a fully reconciled record of business income and expenses to streamline the tax return process.

- Monitor Profitability: Use the reconciliation process to allocate expenses to specific jobs or projects, giving you a true measure of their profitability.

Why is Bank Reconciliation Important?

A business’s ability to invest in marketing, R&D, and technology hinges on having the necessary cash flow. Bank reconciliation is a critical process that informs a company whether it has the financial capacity to undertake new initiatives or if it should refrain from spending. Here are key reasons why bank reconciliations are vital:

The 4 main reasons to reconcile banks

- Accurately Track Cash Flow: Understanding the money flowing into and out of your accounts is essential for making informed financial decisions. This insight helps with everyday decisions, like when to pay vendors, and larger strategic choices, such as issuing dividends. Bank reconciliations give a clear and definitive picture of your business’s available cash, ensuring you have the information needed to manage your finances effectively.

- Build Business Confidence: Reliable and up-to-date financial data are crucial for making sound business decisions. Incomplete or outdated information can lead to mistakes, such as overextending on a payment or missing out on investment opportunities. Accurate bank reconciliations provide the confidence needed to manage operations smoothly, whether it’s covering bills, hiring new staff, or purchasing assets.

- Detect Fraud Quickly: Conducting detailed bank reconciliations can quickly highlight any discrepancies or suspicious activities. For example, if a check for $440 appears as a $490 debit on your bank statement, it raises an immediate red flag. Prompt detection of such issues helps prevent financial losses and protects the integrity of your business operations.

- Address Accounts Receivable Issues: Regular bank reconciliations help identify problems with receivables, such as unpaid invoices. By keeping track of incoming payments, businesses can take timely corrective actions, such as following up with clients or adjusting credit policies, to improve cash flow and financial health.

Challenges With Bank Reconciliations

When attempting to resolve discrepancies between their books and bank statements, accountants often encounter several common issues. Here are some of the typical challenges faced during the bank reconciliation process:

- Uncleared Checks: These are payments that have been issued but have not yet been processed by the bank. Accountants must account for these uncleared checks during reconciliation. Similarly, checks received from customers and recorded by the business may not yet have cleared the banking system, requiring adjustments.

- Voided Checks Clearing: Occasionally, a check the company voided may still clear the bank. Although this is not a frequent occurrence, it must be identified and recorded during the reconciliation process to ensure accuracy.

- Returned Deposited Checks: Sometimes, a payment cannot be processed by the bank. This can happen for several reasons, such as insufficient funds in the customer’s account, a stop payment order, or errors like an unsigned check. Additionally, if a company delays depositing a check until it’s stale-dated (more than six months old), it may be returned. These returned checks need to be identified and adjusted for during reconciliation.

- Bank Service Fees: Various bank services come with fees, such as charges for account services, electronic transactions, or expedited payments. Often, the exact amount of these fees isn’t known until they appear on the bank statement, necessitating adjustments to the company’s books to reflect these expenses accurately.

- Interest Income: Interest earned on bank accounts is another figure that may not be known until it appears on the bank statement. This income must be added to the company’s financial records during the reconciliation process.

- Manual Errors: Human errors in data entry, such as transposing numbers or recording incorrect amounts, can cause mismatches. Identifying and correcting these errors is an essential part of the reconciliation process.

- Duplicate Transactions: Sometimes, transactions might be recorded twice in the company’s books or the bank statement. Detecting and eliminating these duplicate entries ensures the accuracy of financial records.

- Unrecorded Transactions: Occasionally, transactions such as direct debits, bank charges, or automatic payments might be missed in the company’s records. Reconciling these unrecorded transactions is necessary to maintain accurate books.

- Currency Fluctuations: For businesses dealing in multiple currencies, exchange rate differences can create discrepancies between the recorded amounts and the actual bank transactions. Adjusting for these fluctuations is a critical aspect of reconciliation.

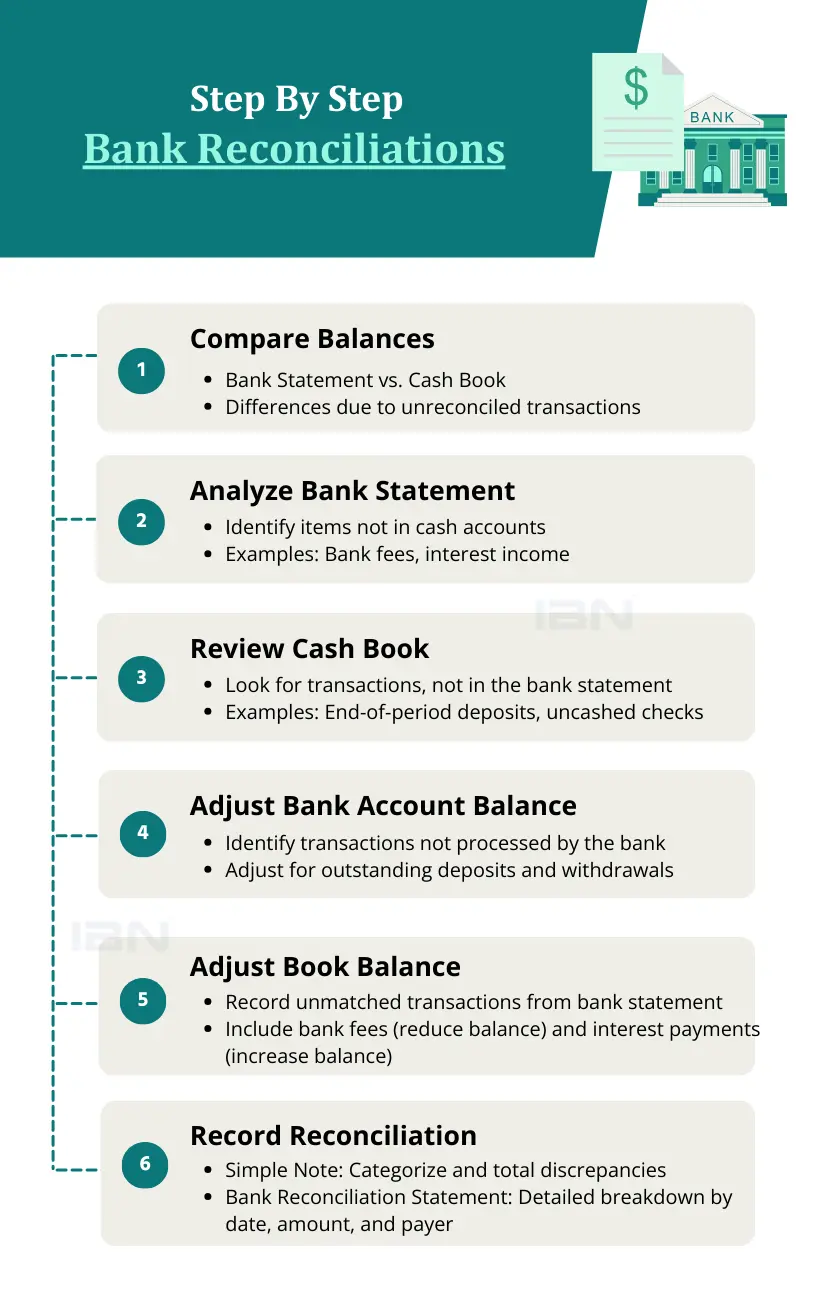

How to Do Bank Reconciliations Step by Step

A business’s financial records must be accurate in order to succeed. Bank reconciliation is a systematic process that ensures your company’s cash balance aligns with your bank statement. The following infographic provides an overview of the six key steps:

Benefits of Bank Reconciliation

- Enhance Financial Planning: Regular reconciliations provide a solid foundation for financial planning and budgeting. By knowing exactly where your finances stand, you can make more accurate forecasts and set realistic financial goals

- Improve Audit Readiness: Keeping reconciled financial records makes it easier to prepare for audits. Accurate and organized records demonstrate good financial management practices and help streamline the audit process.

- Strengthen Vendor Relationships: Timely payments foster good relationships with vendors. By reconciling bank statements regularly, you ensure that you are aware of outstanding payments and can manage them promptly, maintaining trust and reliability with your suppliers.

- Optimize Expense Management: During the reconciliation process, you can review and categorize expenses accurately. This practice not only aids in tax preparation but also helps in identifying areas where cost savings can be achieved.

- Boost Overall Financial Health: Consistent bank reconciliations contribute to the business’s overall financial health. By keeping a close eye on all transactions, businesses can avoid financial pitfalls, make better-informed decisions, and ensure long-term sustainability.

Simplify Bank Reconciliations with IBN Technologies

Regular bank reconciliation serves as a financial fortress for your business. It helps identify errors, prevent fraud, and ensures your financial records are accurate. This, in turn, fosters informed decision-making and strengthens your company’s financial standing.

- For a Streamlined Approach: For a more efficient reconciliation process, explore IBN Technologies’ outsourced finance and accounting services. Our comprehensive solutions are designed to meet your business’s financial management needs. We provide detailed reports, pinpoint discrepancies, and connect you with expert support. This allows you to close your books with confidence and dedicate your time to growing your business.

Bank Reconciliation FAQs

Q.1 Why do we do bank reconciliation?

Bank reconciliation is performed to ensure that the company’s financial records (ledger) match the bank’s records, identifying any discrepancies and ensuring the accuracy of financial statements.

Q.2 What is the primary purpose of a bank reconciliation?

The primary purpose of a bank reconciliation is to detect and correct errors or discrepancies between the bank statement and the company’s accounting records.

Q.3 Why are bank reconciliations important for businesses?

Bank reconciliations are important for businesses to ensure the accuracy of their financial records, detect fraud, manage cash flow effectively, and provide reliable financial reporting.