Maintaining cash flow management and the financial stability of your company is a challenge for you. How much stress do you experience when it comes to paying your bills or supporting your business growth? If so, you are not by yourself. It can be difficult to identify ways to increase cash flow, which is a frequent issue for many businesses.

It can be problematic to pay bills, fund operations, and invest in growth without a consistent flow of cash. If your company is struggling with cash flow, it’s important to take action to improve the situation. Here are 10 solutions to help keep your business financially healthy.

Understanding Cash Flow and Its Different Types

Money receiving and exiting a business, or an individual is referred to as cash flow. It refers to the total amount of money made or spent during a given time frame, usually a month or a year.

There are several types of cash flows that businesses and individuals may experience:

1.Operating cash flow

Cash is generated from the day-to-day operations of a business. Expenses such as payroll, rent, and supplies are included in them.

2.Investing cash flow

Cash is used for investments in long-term assets, such as purchasing equipment or investing in real estate.

3.Financing cash flow

Cash is used for financing activities, such as issuing debt or equity, repaying loans, or paying dividends to shareholders.

4.Free cash flow

Cash is available to a business after it has paid for all its operating expenses and invested in long-term assets. It is a measure of a company’s financial health and can be used to pay off debt, make acquisitions, or return money to shareholders through dividends or share buybacks.

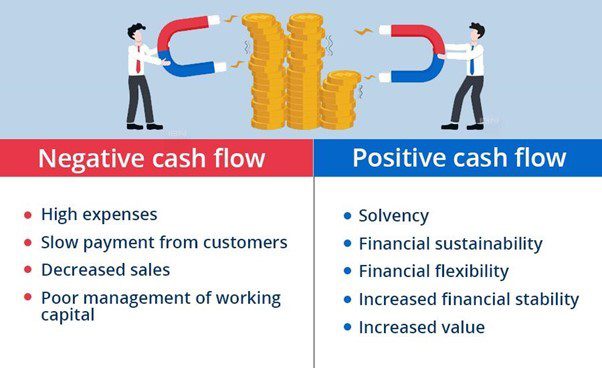

Cash flow describes a company’s situation when a company’s cash inflows exceed its cash outflows, it might have a positive cash flow even if it is losing money overall. While negative cash flow implies that a company’s cash inflows exceed its cash outflows. This can be a sign of financial distress and may require the business to take action to improve its cash flow.

Negative cash flow: what happens

A negative cash flow can be a warning sign that a company is in financial trouble. If a company consistently has more cash going out than coming in, it may eventually run out of cash and be unable to pay its bills or meet its financial obligations. This can lead to financial problems such as defaulting on loans, difficulty paying employees and suppliers, and even bankruptcy.

There are several reasons why a company may have negative cash flow, including:

- High expenses:If a company’s expenses are too high relative to its revenue, it can lead to negative cash flow.

- Slow payment from customers:If a company’s customers are slow to pay their bills, it can lead to a shortage of cash.

- Decreased sales: If a company’s sales are declining, it can lead to a decrease in cash inflow.

- Poor management of working capital: The company needs funds for its day-to-day operation is called working capital. If a company is not managing its working capital effectively, it can lead to negative cash flow.

If a company is experiencing negative cash flow, it may need to take steps to improve its financial situation. This could include finding ways to reduce expenses, improving collections from customers, increasing sales, or seeking additional funding.

Benefits of having a positive cash flow

Positive cash flow is generally considered to be a good thing, as it indicates that a business or individual is generating enough income to meet its financial obligations and have some left over. Having positive cash flow is important for the long-term viability of a business. It means that the company is generating more cash than it is spending, which can provide a number of benefits.

Some of the benefits of having positive cash flow include:

- Solvency: In order to maintain good relations with suppliers, investors, as well as other creditors, a business must be able to pay its payments as they become creditors.

- Financial sustainability: Positive cash flow allows a company to fund its day-to-day operations and invest in new opportunities, such as hiring new employees, expanding into new markets, or developing new products.

- Financial flexibility: Positive cash flow is more likely to be able to obtain financing from banks or other lenders. This can provide the company with additional funds to invest in its growth.

- Increased financial stability: Positive cash flow can provide a company with a buffer against unexpected expenses or downturns in the market. It can help the company weather financial storms and increase its overall financial stability.

- Increased value: Companies with positive cash flow are often more valuable to investors, as they have a proven track record of generating cash and are less risky to invest in.

Ways to improve your cash flow problems

There are different ways to improve your cash flow problems in small business if it is not where you want it to be:

- Examine your billing process to ensure that invoices are sent out on time and correctly.

- Examine your payment conditions with clients and suppliers to ensure they are feasible and useful to your company.

- Implement a credit control system to properly manage your client relationships and hunt down late payments.

- Examine your pricing strategy to guarantee you’re producing enough money to pay your expenses and enhance your cash flow.

- Examine your spending to verify that you are not overspending and placing undue strain on your cash flow.

- Speak with your bank about setting up an overdraft or other kind of funding to help you with your financial flow in the short term.

- Consider invoice financing or arranging to boost your cash flow by freeing funds held in outstanding invoices

- Examine your business strategy and operations to see if there are any areas where you can enhance efficiency and cut costs.

- Improve your financial planning and forecasting to gain a better grasp of your future cash flow requirements.

- Consult with a professional advisor for guidance on how to enhance your cash flow problems.

What can IBN Tech do for you?

Are you seeking ways to encourage long-term success in your company? Do you feel you may be experiencing cash flow challenges but are unsure how to solve them? At IBN Tech , we have a team of experienced CFOs who can help you. Furthermore, IBN Tech has over 22 years of experience and competency in the fields of integration, controller services, bookkeeping services, and accounting systems, having worked with over 200 clients. Allow us to assist you in achieving long-term success for your company by controlling its financial health.

READ MORE: – 12 BUDGET STRATEGIES TO IDENTIFY GROWTH OPPORTUNITIES

Summary

Cash flow management is like the backbone of a small business – it keeps everything running smoothly. But it’s not just about numbers, it’s about values too. Keeping up with payments, managing credit ethically, and considering the impact of decisions on all stakeholders including suppliers, employees, and the community, are all essential for building a sustainable and responsible business. By looking at cash flow management as a whole, small businesses can create a solid foundation for long-term success and growth, making sure it aligns with their moral values.