Accounting is a critical part of running a successful small business. It helps you track your finances, pay bills, and plan for the future. But it can be daunting to try and keep up with all the paperwork, especially if you’re just starting out.

Fortunately, there are plenty of accounting software solutions that can make the job easier. Here, we’ve compiled a list of the top 10 accounting software perfect for your small business.

From cloud-based programs to desktop software, you’ll find the perfect accounting solution to fit your needs. So keep track of your finances, balance your books, and make smarter decisions with the best accounting software for small businesses.

10 Top Accounting Software for Small Businesses

You can pick any of the following depending on your budget and use case.

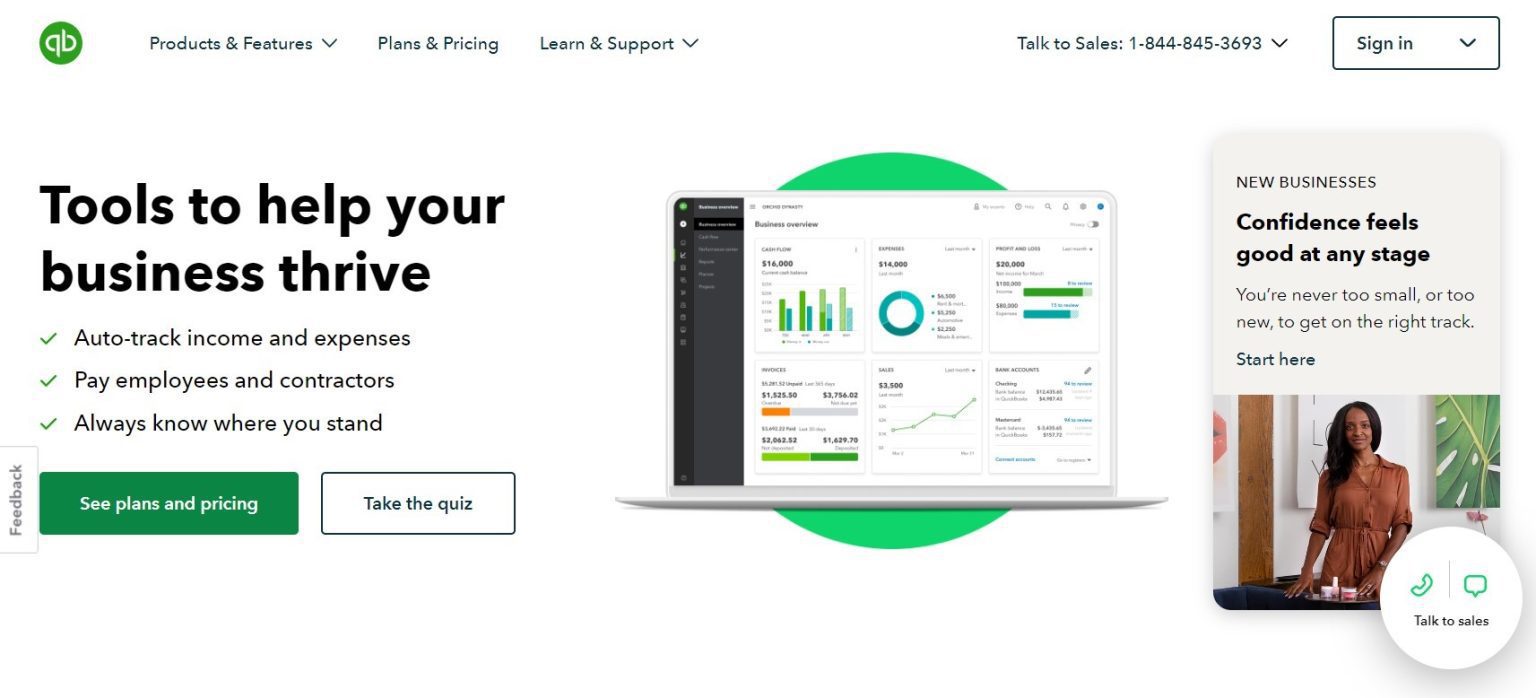

1. QuickBooks

QuickBooks is one of the top accounting software solutions developed by Intuit that helps small businesses manage their finances. It offers a range of features, including invoicing, inventory management, payroll, and more. QuickBooks also integrates with popular third-party applications and offers a mobile app for users on the go.

Features

Create and send customized invoices to customers with payment tracking options.

Track expenses from vendors, contractors, and other sources.

Automate payroll processes for employees, including direct deposits, tax filing, and more.

Generate reports quickly to gain insights into business performance.

Track inventory levels in real-time to ensure accuracy and prevent stockouts.

Manage finances in multiple currencies with automatic exchange rate updates.

Access QuickBooks on the go with the mobile app available for iOS and Android devices.

Pros

Easy to use interface makes it easy for users of all skill levels to navigate the software quickly without needing extensive training or support staff

Offers comprehensive features that can help businesses manage their finances efficiently while staying compliant with local regulations

Integrates seamlessly with popular third-party applications such as PayPal, Shopify, Salesforce, etc., allowing users to transfer data between systems as needed easily

Cons

Limited customization options make it difficult for businesses to tailor the software to meet their specific needs or preferences

Costly when compared to other accounting solutions on the market today, which offer similar features at lower price points

Pricing

QuickBooks offers four different pricing plans ranging from $15/month up to $100/month depending on the features required by each user’s business needs; all plans include free customer support for issues that may arise.

2. Xero

Xero is a cloud-based accounting software designed to help small and medium businesses manage their finances in the most efficient way. It offers features such as invoicing, bill payment, payroll, expense tracking, and bank reconciliation. Xero also provides access to real-time financial data, allowing users to make informed decisions quickly and easily.

Top Features

Automated bank feeds that sync with your company bank accounts so you can easily track income and expenses

Automatically generate invoices from templates with the ability to customize them for each customer

Track payments from customers and vendors, set up recurring payments for regular bills or invoices, and generate reports for tax filing or other purposes

Payroll management with employee self-service portal for easy access to pay stubs, vacation requests, etc.

Customizable dashboards with key performance indicators (KPIs) so you can track your business’s performance in real-time

Pros

An easy-to-use interface that requires minimal training or support staff to get started quickly

A comprehensive set of features that help businesses manage their finances efficiently while staying compliant with local regulations

Integrates seamlessly with popular third-party applications such as PayPal, Shopify, Salesforce, etc., allowing users to transfer data between systems as needed quickly

Cons

Limited customization options make it complex for businesses to personalize the software to meet their specific needs or preferences

Pricing

Xero offers three different pricing plans ranging from $13/month up to $70/month depending on the features required by each business needs; all the pricing plans include free customer support.

3. FreshBooks

FreshBooks is a cloud-based accounting software designed to help small businesses track their finances and stay organized. It allows users to create professional invoices, receive payments online, track expenses and mileage, generate tax-compliant reports, and keep projects on track with timesheets.

FreshBooks has an easy-to-use interface with intuitive navigation, which makes it quick and easy for businesses to manage their finances. In addition, the automated invoicing system helps ensure that all clients are invoiced automatically and accurately, while payment reminders help ensure timely payment of those invoices.

FreshBooks also offers built-in payment gateway integrations for credit cards and ACH transfers so businesses can accept payments from customers quickly and securely. This makes it ideal for small businesses that need a simple yet powerful solution for managing their finances.

Features

Generate professional invoices

Automated payment reminders

Track expenses and mileage

Generate tax-compliant reports

Receive payments online

Track projects with timesheets

Pros

Easy-to-use interface with intuitive navigation

Built-in payment gateway integrations for credit cards and ACH transfers

Automated invoicing and reminders for recurring payments

Ability to bill clients in multiple currencies

Cons

Limited customization options on invoices (e.g., no logo upload)

No inventory management system or purchase order tracking

Pricing

FreshBooks offers three pricing plans starting at $4.5/month up to $16.50/month. The accounting software also offers custom pricing options for enterprises.

4. Wave

Wave is an all-in-one financial management platform designed for small businesses. Wave streamlines the entire financial process for small businesses with features like automated invoicing and payment reminders, expense tracking tools, built-in tax forms, multi-currency support, bank integrations, and more.

Wave also offers free financial advice from a community of experts to help small business owners make more informed decisions. The software is based on the cloud, which means you can access it from anywhere with an internet connection.

Features

Create professional invoices and estimates

Integrated payroll services to streamline payments and taxes

Automated payment reminders to customers

Track income, expenses, sales, and profits

Connect with banks to sync financial information

Generate reports to stay up-to-date on taxes, profits, etc.

Pros

Easy-to-use interface with helpful tips throughout the platform

Offers integrated payroll services to streamline payments and taxes

Free version available for basic needs without the added cost

Ability to connect with banks to easily sync financial information

Cons

Limited customization options on invoices (e.g., no logo upload)

No inventory management system or purchase order tracking

Pricing

Wave offers a free version of the software that brings along basic Invoicing, Accounting, and Banking features. The two paid versions start at $40/month up to $149/month, depending on the size of the business.

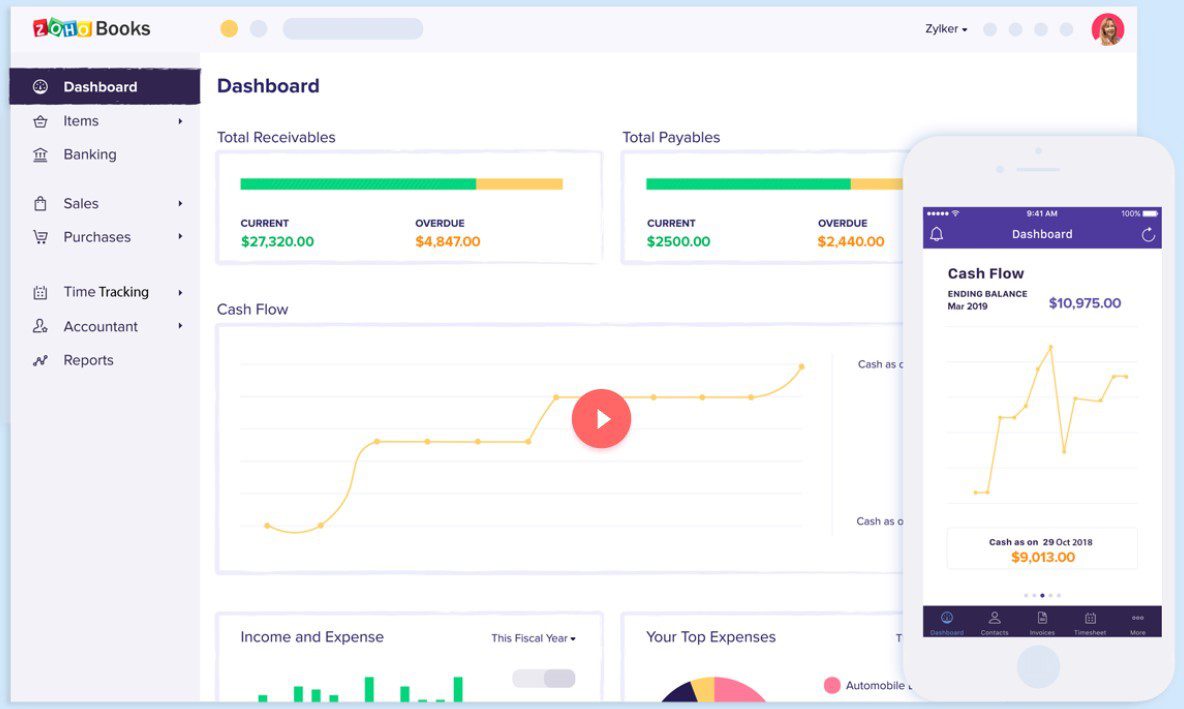

5. Zoho Books

Zoho Books is a cloud-based accounting software solution that can help small businesses manage their accounts more efficiently. It provides features such as invoicing, tracking income and expenses, creating reports, and connecting to banks for financial data synchronization.

This software also offers automated payment reminders to customers and automated payroll services for streamlining payments and taxes. The user interface is easy to use, with helpful tips throughout the platform, making it easier for small businesses to get started.

Additionally, Zoho Books offers customization options on invoices and an inventory management system to track purchase orders.

Overall, Zoho Books is awesome for small businesses looking for an all-in-one accounting solution with simple yet effective tools to manage their finances more efficiently.

Features

Invoicing

Tracking income and expenses

Creating reports

Connecting to banks for data synchronization

Automated payroll services

Pros

All-in-one accounting solution for small businesses

Simple yet effective tools

Robust features for managing finances more efficiently

Cons

Limited customization options on reports and invoices

Pricing

The plans for Zoho Books start with a free version, which offers 1 user plus 1 accountant access which is fine for small businesses. Moreover, the paid plans start at $15/month and up to $240/month, depending on the size of the business.

6. Sage 50cloud Accounting

Sage 50cloud Accounting is an all-in-one accounting and business management solution designed for small businesses. It offers extensive features to help small businesses manage their finances more efficiently, including automated invoicing, payroll, inventory tracking, and bank reconciliation.

Sage 50cloud also integrates with popular payment processors like PayPal and Stripe, allowing business owners to accept payments online quickly and securely. Additionally, Sage 50cloud includes a built-in customer relationship management tool to help business owners keep track of their customers’ contact information and purchase history.

Lastly, the software provides access to financial analytics tools that can provide valuable insights into the performance of the business. With its wide range of features and intuitive user interface, Sage 50cloud is one of the best choices for small businesses looking for a comprehensive accounting solution.

Features

Automated invoice and payroll processing

Bank reconciliation

Inventory tracking

Online payments with PayPal and Stripe

Built-in customer relationship management (CRM)

Financial analytics tools for business performance insights

Pros

Streamlines accounting processes and saves time

Offers accurate tracking of finances, inventory, and customers

Incorporate customizability to fit the needs of any small business

Cons

Limited customization options on reports and invoices

Pricing

Sage 50cloud offers three different pricing plans that range from $34.30-$91.45 per month.

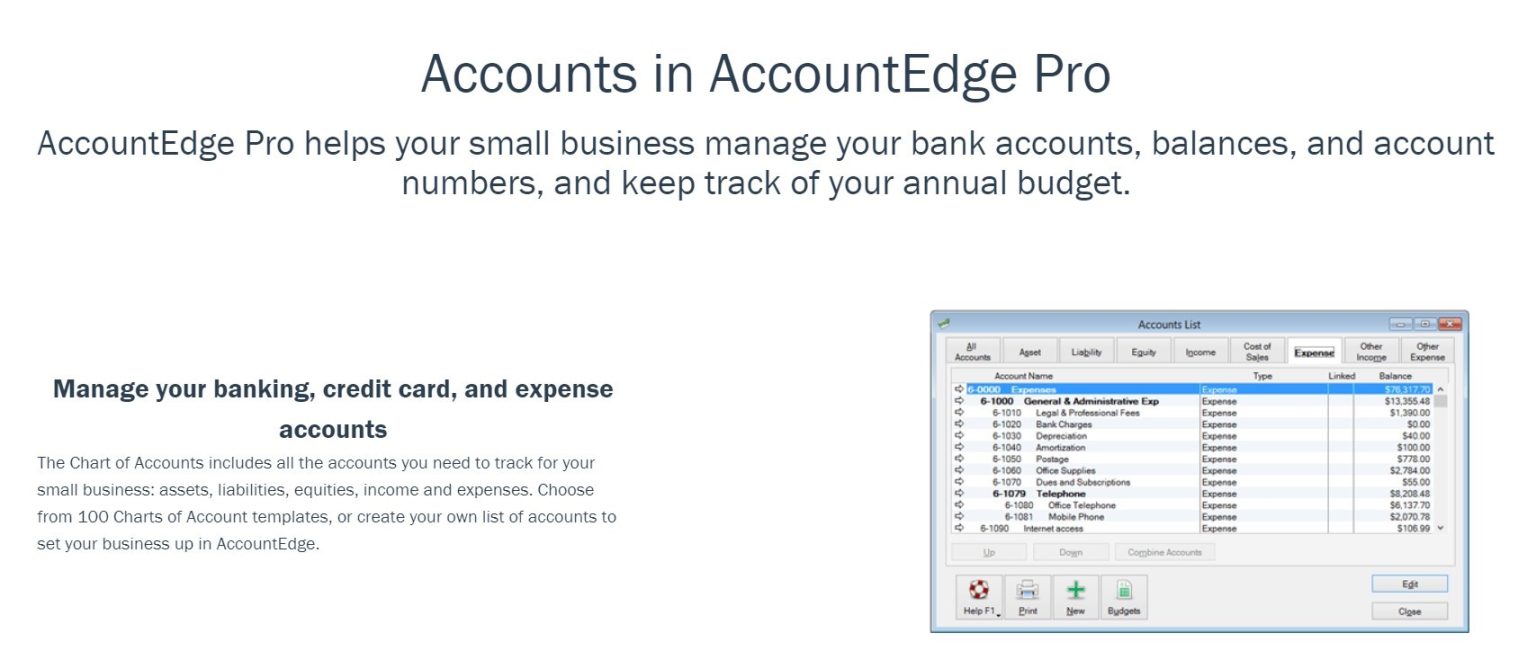

7. AccountEdge Pro

AccountEdge Pro is an accounting software designed specifically for small businesses. It boasts a plethora of features that make it easy to manage finances, track inventory, and generate reports.

The software is designed to be user-friendly and can be personalized to meet the needs of any small business. It has a powerful set of invoicing and payroll functions, as well as comprehensive tracking for customer accounts receivable (AR) and accounts payable (AP).

AccountEdge Pro also includes built-in reporting tools that can provide in-depth insights into the financial performance of a business. This makes it easy for small businesses to identify trends, forecast cash flow, and make better decisions about their operations.

Overall, AccountEdge Pro is one of the best choices for small businesses looking for an affordable yet comprehensive accounting software solution.

Features

Accounting & bookkeeping functions, including invoicing, payroll, and accounts receivable/payable tracking

Comprehensive reporting tools to view financial performance and identify trends

Easy-to-use interface with customizable options

Full integration with other business software solutions

Pros

A powerful set of features designed specifically for small businesses

Affordable pricing model with no additional costs for upgrades or extra users

Comprehensive reporting and forecasting tools to aid in decision-making

Intuitive user interface with customization options to suit any business needs

Cons

Not suitable for larger businesses due to a lack of scalability and certain features like multi-currency support

Pricing

AccountEdge Pro is available at a $499 licensing fee for one time.

8. Kashoo

Kashoo is a cloud-based accounting software designed specifically for small businesses. It offers a comprehensive suite of features to manage finances, including invoicing, expense tracking, VAT and GST calculations, bank reconciliation, and more. The software also provides detailed reporting capabilities to make informed decisions about the business.

Kashoo is easy to use and comes with an intuitive user interface that can be customized for any small business needs.

With its affordable pricing model and no additional costs for upgrades or extra users, Kashoo is an excellent solution for small businesses looking for a reliable accounting system.

Features

Invoice creation

Online payments

Bank reconciliation

VAT/GST calculation

Multi-currency support

Expense tracking

Reporting and analysis

Pros

An intuitive user interface

A comprehensive set of features

Affordable pricing model with no extra costs for additional users or upgrades

Cons

Limited customization options for invoices

Basic functionalities

Pricing

The plan for small businesses is $20 per month.

9. FreeAgent

FreeAgent is a cloud-based accounting software developed specifically for small businesses and freelancers. FreeAgent has all the features necessary to help small businesses track income, expenses, invoices, payments, and payroll.

It also includes detailed reporting capabilities so users can better understand their financial data. Additionally, it provides real-time tax calculation tools that can generate VAT/GST-compliant invoices automatically.

It also includes detailed reporting capabilities so users can better understand their financial data. Additionally, it provides real-time tax calculation tools that can generate VAT/GST-compliant invoices automatically.

FreeAgent is easy to use and offers great customer support through email and live chat. FreeAgent can be a great fit for any small business looking for reliable accounting software with its affordable pricing model, free trial period, and no long-term contracts.

Features

Complete financial tracking with income, expenses, invoices, payments, and payroll management

Real-time tax calculation tools that generate VAT/GST-compliant invoices automatically

Detailed reporting capabilities

Easy to use with excellent customer support through email and live chat

Pros

Affordable pricing model

No long-term contracts are required

Free trial available

Comprehensive features for small businesses and freelancers

Cons

No mobile app is available yet

Pricing

FreeAgent offers a universal plan for $10 per month.

10. Manager

Manager accounting software is a comprehensive cloud-based accounting tool that helps small businesses manage their finances. It offers a variety of features designed to make managing finances easier, including invoicing, budgeting, and reporting capabilities. It also provides real-time tax calculations, payroll management, and access to detailed reports.

Manager allows users to track income and expenses, create invoices, record payments and set up automatic payments.

The software also allows for secure collaboration with accountants or other users on projects or tasks. In addition, the Manager’s user-friendly interface makes it easy for even the most inexperienced users to get up and running quickly.

All Manager plans come with 24/7 customer support via email and live chat, making it an ideal choice for small businesses looking for an affordable yet reliable solution.

Features

Invoicing and billing

Real-time tax calculations

Payroll management

Access to detailed reports

Budgeting tools

Automated payments and reminders

Secure collaboration with other users or accountants

Pros

The user-friendly interface makes it easy for even inexperienced users to get up and running quickly

Offers a variety of features designed to make managing finances easier

24/7 customer support via email and live chat

An affordable yet reliable solution

Cons

Limited customization options for reports and invoices.

Pricing

The desktop version of Manager accounting software is free to use.

The Right Accounting Team and Tech Stack is a Perfect Match

Having the right accounting team is essential for any business, even if you have the best accounting software. The software can help automate some of the more mundane tasks, but it cannot replace the knowledge and expertise of a qualified accountancy team.

An experienced accountant can provide valuable insights into financial accounting trends and decisions, helping to ensure that your finances are managed efficiently and effectively. They can also provide guidance on how to optimize your business’s financial performance and help you comply with all relevant regulations.

Furthermore, they can help identify areas where cost savings could be made or where improvements could be made in order to increase profits. In short, having the right accounting team is an invaluable asset for any business, and it is cost effective.