Did you know that a simple, yet powerful technique can significantly improve the accuracy and security of your business’s financial transactions? The 3-way match offers a comprehensive solution. This innovative approach empowers businesses to validate and process invoices with precision, minimizing errors and safeguarding against fraud. This article delves into the essence of 3-way matching in accounts payable automation, unraveling its workings, benefits, and practical applications.

Table of Contents

- What is 3-Way Matching in Accounts Payable?

- How Does 3-Way Matching Work?

- The Importance of 3-Way Matching in Accounts Payable

- 3-Way Matching Challenges and Solutions

- Conclusion

- 3-way Matching FAQS

What is 3-Way Matching in Accounts Payable?

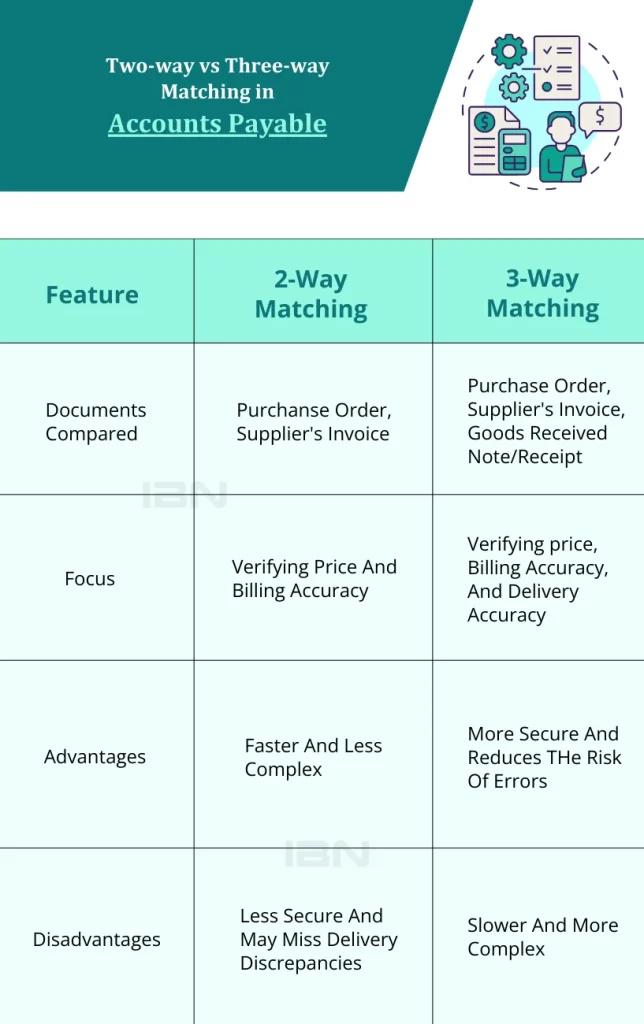

At its core, 3-way matching is a verification process used in accounts payable to ensure that payment transactions are legitimate and accurate before funds are released. The “three-way” aspect refers to the comparison of three key documents: the purchase order (PO), the goods receipt note (GRN), and the invoice. This trio of documents must align in detail – from quantities and prices to descriptions and terms – to pass the 3-way match test. This is contrasts with 2-way matching, which typically involves comparing only the purchase order with the invoice.

Explore the difference between 2-way matching and 3-way matching by contrasting their processes.

How Does 3-Way Matching Work?

The 3-way matching process unfolds in a series of checks and balances designed to catch discrepancies and prevent unauthorized payments. It typically involves the following steps:

- Purchase Order Creation: Everything begins with a purchase order, which outlines what is being bought, in what quantity, and at what price. This document sets the expectations and authorizes the purchase.

- Goods Receipt: Upon receiving the goods, a receiving report is generated to confirm the delivery matches the purchase order in terms of quantity and quality.

- Invoice Approval: The final piece of the puzzle is the invoice received from the supplier. The invoice must match the details in the purchase order and the receiving report to be approved for payment.

This systematic process ensures that every payment is justified, helping businesses manage their cash flow more effectively and protect against fraudulent activity.

The Importance of 3-Way Matching in Accounts Payable

The significance of the 3-way match system cannot be overstated. It serves as a critical control mechanism within the financial operations of a company, offering several key benefits:

- Cost Control: By verifying that only goods and services received are paid for, businesses can avoid overpaying.

- Enhance Accuracy: The meticulous matching process promotes accurate record-keeping and financial reporting.

- Prevent Fraud: By requiring confirmation at multiple steps, the opportunity for fraudulent billing is greatly reduced.

- Improve Vendor Relationships: Paying accurately and on time, based on verified deliveries, builds trust with suppliers.

3-Way Matching Challenges and Solutions

Despite its benefits, 3-way matching can be complex and time-consuming, particularly for businesses that handle a high volume of transactions or those relying on manual processes. Challenges include paperwork mismatches, delays in receiving documents, and the labor-intensive task of manually comparing details. However, modern solutions like automated accounts payable systems are increasingly overcoming these hurdles, streamlining the 3-way match process with features like electronic document management, automated matching, and exception handling.

At IBN Technologies, we’re dedicated to modernizing the 3-way matching process in accounts payable. Our extensive experience with software applications allows us to provide innovative solutions that optimize invoice processing. We offer seamless integration with your existing software system, maximizing efficiency and accuracy.

Our diverse team possesses a deep understanding of various platforms, enabling us to customize solutions that align with your unique needs. We go beyond electronic document management by offering comprehensive automation services that drive innovation and performance, ensuring you stay competitive. Embrace the future with IBN Technologies and experience enhanced productivity, streamlined workflows, and sustainable growth.

Conclusion

The meticulous 3-way match remains a cornerstone of financial security, safeguarding against inaccuracies and fraud. By embracing automation, businesses can not only maintain control but also unlock a future of efficiency, compliance, and flourishing supplier relationships, solidifying the foundation for long-term success.

3-way Matching in AP automation FAQs

- Q.1 What is 3-way matching, and why is it important?

- 3-way matching is a verification process in accounts payable, ensuring that payment transactions are legitimate and accurate before funds are released. It’s crucial for financial security, safeguarding against inaccuracies and fraud.

- Q.2 How does the 3-way matching process work?

- The process involves comparing three key documents: the purchase order (PO), goods receipt note (GRN), and invoice. These documents must align in detail, including quantities, prices, descriptions, and terms, to pass the 3-way match test.

- Q.3 What are the benefits of 3-way matching?

- 3-way matching offers several benefits, including cost control, enhanced accuracy in record-keeping and financial reporting, fraud prevention, and improved vendor relationships through accurate and timely payments.