Assessing risks is crucial in today’s business landscape, especially for vulnerable functions like accounts payable. Collaborating closely with procurement accounts payable ensures timely payments and tangible ROI for each dollar spent. Yet, many businesses face inefficiencies and risks in this area, including manual processes, duplicate invoices, payment errors, and fraud. In this article, we’ll delve into accounts payable risks, how to identify them, and strategies to address them effectively.

Table of Contents

- 1. What is Accounts Payable Risk Assessment?

- 2. Accounts Payable Risks to look out for/Identifying Sources of Risk

- 3. Accounts Payable Risk Identification

- 4. The Role of Technology in Risk Mitigation

- 5. Conclusion

- 6. FAQs

What is Accounts Payable Risk Assessment?

Frequently mistaken for an accounts payable audit, the accounts payable risk assessment serves the pivotal purpose of discerning and evaluating multifarious risks that possess the potential to impede the seamless functioning of this domain. These risks encompass a broad spectrum, spanning aspects such as vendor management, invoice processing, payment processing, and interconnected areas.

Diverging from the retrospective nature of an audit, which retrospectively examines a company’s financial records for precision, the risk assessment is characterized by its proactive approach to identifying latent threats before their actualization. This comprehensive assessment extends its scope to appraising the efficacy of internal checks and controls, while concurrently gauging the potential magnitude of these identified risks. Notably, it also presents recommendations tailored towards enhancing existing protocols, with the ultimate objective of pre-emptively mitigating or altogether eradicating these identified risks.

Accounts Payable Risks to look out for/Identifying Sources of Risk

At the outset of the AP risk assessment process, the primary it involves the meticulous identification of all conceivable avenues for potential risk. The overarching aim herein is to unveil latent vulnerabilities within areas characterized by potential deficiencies in checks and internal controls. Herein follows an enumeration of notably vulnerable domains:

Expenditures conducted beyond the purview of the accounts payable procedures constitute a substantial wellspring of risk. A considerable portion of these expenditures lacks direct association with vendor contracts and often lacks verifiable payment substantiation.

Often, cases of accounts payable fraud originate from employees within the organization. These situations might entail altering vendor records or creating fake vendors to unlawfully obtain payments. These wrongdoings can go unnoticed because they remain beneath the level that receives thorough scrutiny from internal controls. Another type of internal misconduct involves check fraud, where an employee diverts company funds to a fraudulent account.

External fraud

Duplicate Payments:

Becoming a significant hurdle in the field of payments, the issue of duplicate transactions continues to trouble companies. Situations arise where suppliers end up receiving duplicate payments due to receiving identical invoices in different formats or because of unintentional oversight by employees.

Unapproved Supplier Transactions:

A noteworthy concern materializes when payments are directed towards fictitious or unauthorized suppliers, for fictitious or spurious goods and services.

Overlapping Responsibilities of Staff Members

Frequently, staff members find themselves managing diverse job functions within a demanding work environment. This situation significantly elevates the susceptibility to accounts payable fraud. To illustrate, an instance might involve a staff member responsible for overseeing physical inventory checks, who simultaneously holds the authority to approve payments from the company’s account.

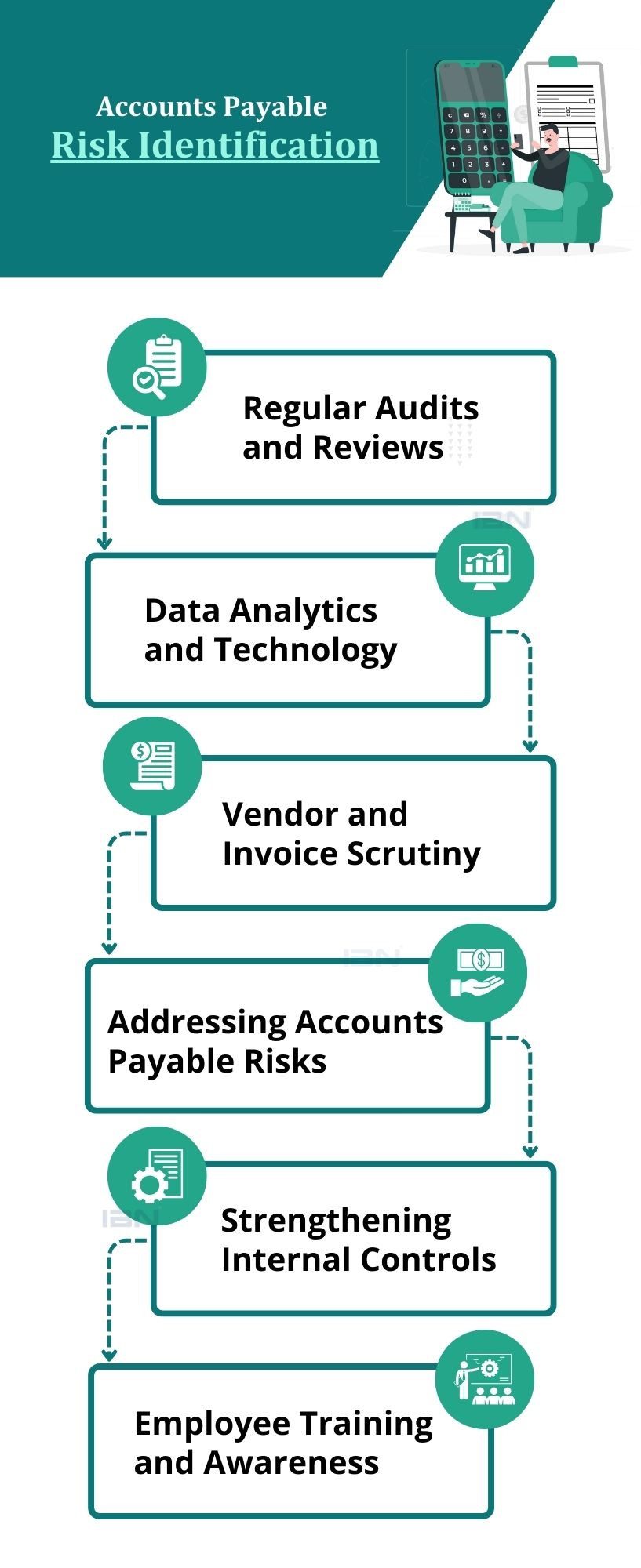

Accounts Payable Risk Identification

Regularly auditing and reviewing accounts payable processes is a crucial measure for identifying potential risks. This proactive approach enables businesses to detect and address issues before they escalate into significant concerns.

It is used to identify patterns and trends in accounts payable data. This information can be used to identify potential risks, such as vendors who are consistently overcharging or invoices that are out of line with historical spending.

Businesses should carefully scrutinize vendors and invoices before making payments. This includes verifying the vendor’s identity, checking for duplicate invoices, and ensuring that the invoice is for goods or services that were actually received.

Addressing accounts payable risks:

Once risks have been identified, businesses need to take steps to address them. This may involve implementing new controls, training employees, or terminating vendors.

Strengthening internal controls:

Strong internal controls can help to prevent accounts payable fraud and errors. This includes having clear policies and procedures, segregating duties, and conducting regular audits.

Employee training and awareness:

Employees should be trained on accounts payable procedures and risks. This training should help employees to identify and report suspicious activity.

The Role of Technology in Risk Mitigation

Automated Invoice Matching

Automated invoice matching systems can help to prevent discrepancies between invoices, purchase orders, and receipts. This technology can reduce the likelihood of incorrect payments by ensuring that all three documents match before a payment is made.

AI-Powered Fraud Detection

Utilizing artificial intelligence (AI), fraud detection becomes possible through the analysis of data patterns. By employing AI algorithms, anomalies, and patterns suggestive of fraudulent behaviour can be pinpointed and identified.

Cloud-Based Document Management

Storing invoices and payment records on cloud platforms assures accessibility and safeguards against unauthorized entry. Cloud solutions simplify document retrieval during audits through efficient search and filtering options.

Importance of Communication and Transparency

Effective communication and transparency within the accounts payable process contribute to heightened accuracy. When each stakeholder comprehends their designated roles and obligations, the potential for risks is mitigated.

Monitoring and Continuous Improvement

Ongoing monitoring and periodic reassessment of accounts payable processes allow for continuous improvement. Adapting to emerging risks and optimizing processes is crucial for risk management.

Conclusion

Essential for financial stability and safeguarding reputation, managing accounts payable risks is where IBN Tech excels. As a trusted third-party software provider, it leverages advanced solutions for businesses to pre-empt potential risks. Automation and data-driven insights streamline processes, reducing errors and fraud. IBN Tech prioritizes transparency and adherence to regulations, while also striving to reduce disputes. With this proficiency, businesses can navigate the intricacies of accounts payable with confidence, strengthening their prospects for sustained success.

FAQs

- Q.1 What is the primary purpose of accounts payable?

- The primary purpose of accounts payable is to manage and track the money a company owes to its suppliers, vendors, and creditors for goods and services received. This includes processing invoices, verifying the accuracy of transactions, and ensuring timely and accurate payments are made to external parties.

- Q.2 How can technology help prevent fraudulent activities in accounts payable?

- Technology can prevent fraudulent activities in accounts payable by automating processes, using AI to detect anomalies, implementing approval workflows, and utilizing data analytics. Automation reduces manual errors, while AI can flag suspicious patterns. Approval workflows ensure proper verification, and data analytics identifies irregularities. These technological measures, combined with strong internal controls, create a robust defense against fraud in the accounts payable process.

- Q.3 What are the potential consequences of neglecting accounts payable risks?

- Neglecting accounts payable risks can lead to financial losses, potential fraud, and damage to a company’s reputation. It may result in legal issues, disrupt cash flow, and hinder operational efficiency. Missed discounts, strained vendor relationships, and weakened internal controls are additional consequences that can impact the overall health of the business. Proper attention to accounts payable risks is essential for maintaining financial stability and safeguarding the company’s reputation.