Accounting principles are essential for businesses in this ever-changing economy. These principles are not only ruled to be followed but also serve as a guide for financial stability and successful business management. Without adhering to these standards, organizations may leave themselves open to potential financial issues, such as bankruptcy – particularly for small businesses. It is therefore essential to have an in-depth knowledge of the 13 key accounting principles in order to create viable solutions that can help businesses remain afloat. Let us now take a closer look at these principles, their fundamental role in finance, and why they must be taken into consideration.

Table of Contents

- 1. What are Accounting Principles?

- a. Consistency principle

- b. Full disclosure principle

- c. Materiality principle

- d. Conservatism principle

- e. Economic entity principle

- f. Monetary unit principle

- g. Going concern principle

- h. Time period principle

- i. Matching principle

- j. Reliability principle

- k. Revenue recognition principle

- l. Accrual principle

- m. Cost principle or Historical Cost Principal

- 2. Conclusion

- 3. FAQs

What are Accounting Principles?

Accounting principles as the fundamental concepts and guidelines that serve as the basis for Generally Accepted Accounting Principles (GAAP). GAAP or US GAAP describes the consistent rules that apply to financial statements provided by U.S. businesses to third parties. Accounting principles provide a framework for preparing and presenting financial statements and other accounting information consistently and in a meaningful manner. While some accounting principles are based on traditional accounting practices, others are developed by regulatory bodies such as the Financial Accounting Standards Board (FASB).

Accounting principles are significant because they provide a uniform framework for businesses to adopt when generating financial statements, allowing investors and other stakeholders to understand their financial status.

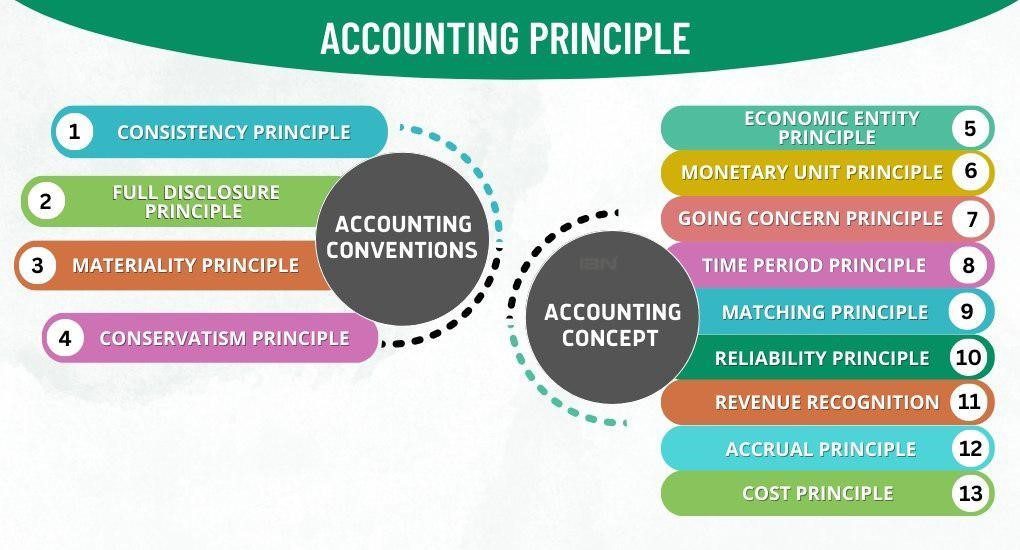

Here are 13 key accounting principles that every accountant should be well-versed in before entering the accounting field.

Consistency principle

The Consistency Principle authorizes companies to use uniform accounting methods, policies, and standards when preparing their financial statements. Strict adherence to this principle offers numerous benefits to stakeholders of financial statements.

It states that an organization’s accounting processes should be consistent from one period to the next.

Full disclosure principle

In accordance with the Full Disclosure Principle, companies must include all pertinent information in their financial statements. The rationale behind this principle is that users of a company’s financial statements rely on such information to make informed decisions.

Materiality Principle

The Materiality Principle, also known as the Materiality Concept, pertains to the significance of information and the size and nature of transactions reported in financial statements.

In line with this rule, financial information is deemed material if its omission or inclusion could potentially mislead users in making their decisions. The materiality of financial information may differ between companies, with specific information being material in one entity’s financial statements while being immaterial in another.

Conservatism principle

The Conservatism Principle focuses on ensuring the reliability of a company’s financial statements, particularly with regard to overstated revenue and assets, as well as understated liabilities and expenses.

This principle necessitates prompt recognition and recording of liabilities and expenses in financial statements when there is any uncertainty about the outcome. Furthermore, the recognition of assets or revenue in financial statements should be avoided when the outcome is uncertain, as doing so may result in the overstatement of revenue and mislead users in their economic decision-making.

Economic entity principle

The Business Entity Concept, also known as the Business Entity Principle, recognizes that the owner of a company bears distinct legal liabilities. As such, the company must maintain separate records of all transactions that are distinct from those of the owner and any other businesses.

According to this principle, only those transactions that pertain to the company should be recorded in the company’s accounts. Financial transactions, assets, liabilities, and equities belonging to the owner or other entities should not be included in the company’s accounts.

Monetary unit principle

The Monetary Unit Assumption is an accounting principle that pertains to the valuation of transactions and events recorded in a company’s financial statements.

This principle allows only those transactions and events that can be measured in monetary terms to be recorded.

Numerous transactions occur within a company on a daily basis, but not all of them are reflected in its financial statements.

Going Concern Principle

The Going Concern Concept posits that companies should be regarded as if they will continue to operate in the foreseeable future. This means that we must presume that the company will not be dissolved or declare bankruptcy unless there is evidence to the contrary. It follows that there will be another accounting period in the future.

Time Period Principle

The time period principle requires that financial statements be prepared at regular intervals, such as annually or quarterly, to supply a snapshot of a company’s financial position at a specific point in time.

Here is more detail about the Periodical Accounting Principle.

Matching Principle

The Matching Principle serves as the foundation for the recognition and recording of expenses and revenues in financial statements. Its primary objective is to ensure that the incomes and expenses listed in the income statement are accurately reflected in the corresponding period of their occurrence. When diligently adhered to, the Matching Principle enables the depiction of net income in the income statement in a true and unbiased manner, free from any potential overstatement or understatement of revenues or expenses.

Reliability Principle

The reliability principle requires that accounting information be based on verified sources and proper record-keeping procedures.

Here is more detail about the Reliability Principle: Key to Accurate Financial Statements

Revenue Recognition Principle

In accordance with the revenue recognition principle, revenue is to be recognized once it has been earned, regardless of when payment is received. A financial statement’s accuracy depends on this principle, which allows financial statements to accurately represent a company’s financial performance. Adherence to this principle guarantees that revenue is reported in the correct period and the correct amount.

Accrual principle

The accrual accounting principle mandates that revenues and expenses be recorded and recognized in an entity’s financial statements upon their occurrence, rather than upon cash payment or receipt. This approach ensures that financial information accurately reflects the entity’s current financial status and economic situation. Unlike cash basis accounting, recognition under accrual accounting is not contingent on cash flow, with revenues recorded and recognized when services or products are sold to customers, and expenses recognized when they are incurred by the entity.

Cost principle or Historical Cost Principle

The cost principle or historical cost principle requires assets to be recorded at the cash amount (or equivalent) paid for them at the time of acquisition. This principle emphasizes the importance of capturing transactions at their original cost, rather than their current market value, in order to provide a reliable and consistent basis for financial reporting.

Small businesses must thoroughly analyze their financial needs as well as boundaries to pick and implement accounting principles. Failure to do so can result in legal and financial consequences like bankruptcy. IBNTech is the optimal solution for overcoming your business challenges and is committed to helping small companies thrive in today’s competitive business environment. IBN Tech Experts With 22 years of experience provide visibility and control over every aspect of your bookkeeping and outsourced accounting services to achieve long-term financial success and supply prompt financial reports while adhering to accounting principles.

Conclusion

Ensuring financial stability is crucial when navigating business bankruptcy. It’s not just business owners and finance experts who should take note – anyone with an interest in managing their finances wisely should recognize the significant role that accounting principles play. Adhering to these principles can have a huge impact on long-term financial success. So don’t underestimate the importance of a solid foundation in accounting!

Accounting Principles FAQ

- Q.1. What are Accounting Principles?

- Accounting principles are rules and guidelines that companies must follow when reporting financial data. A set of accounting principles, standards, and procedures called Generally Accepted Accounting Principles (GAAP) is issued by the Financial Accounting Standards Board (FASB). GAAP supplies guidance on how to record and report accounting information.

- Q.2 How are accounting principles applied?

- Accounting principles are applied by recording financial transactions in a standardized format and preparing financial statements in accordance with GAAP or other relevant accounting principles. Each principle serves a specific purpose to ensure the accuracy and consistency of financial information.

- Q.3. How can I avoid making accounting mistakes that could lead to bankruptcy?

- An effective way of avoiding accounting mistakes that could lead to bankruptcy is by following accounting principles. You should also ensure that you are adequately trained in accounting principles and understand the various aspects of each principle. This will allow you to identify better and avoid errors that could lead to bankruptcy.