Payroll taxes are a crucial aspect of any business that has employees. Therefore, understanding the different types of payroll taxes and how to manage them is important for businesses of all sizes, from small startups to large corporations.

Payroll taxes include federal, state, and local taxes employers and employees pay. Some of the most common payroll taxes in the USA include federal income tax withholding, social security tax, medicare tax, state income tax withholding, and state unemployment tax.

Although managing payroll taxes can be a complicated and time-consuming task, it’s essential to ensure compliance with tax laws and avoid penalties.

This guide will explore the different types of payroll taxes, how they work, and how to manage them effectively. Whether you’re a business owner or a payroll professional, this payroll tax guide will provide you with the information you need to navigate the complex world of employer compliance.

Let’s start with the federal payroll taxes you need to take care of:

Federal Payroll Taxes

The federal government imposes federal payroll taxes on earnings and self-employment income to finance various social insurance programs, including social security, medicare, and unemployment insurance, among others.

Federal taxes are of four types. So let’s discuss them one by one:

1. Federal Income Tax Withholding

Federal income tax withholding is a tax that employers must withhold from their employees’ paychecks. The amount of federal income tax withholding is based on the employee’s W-4 form, which provides information on their filing status, number of dependents, and other factors.

Employers are responsible for calculating and remitting federal income tax withholding to the Internal Revenue Service (IRS) on behalf of their employees.

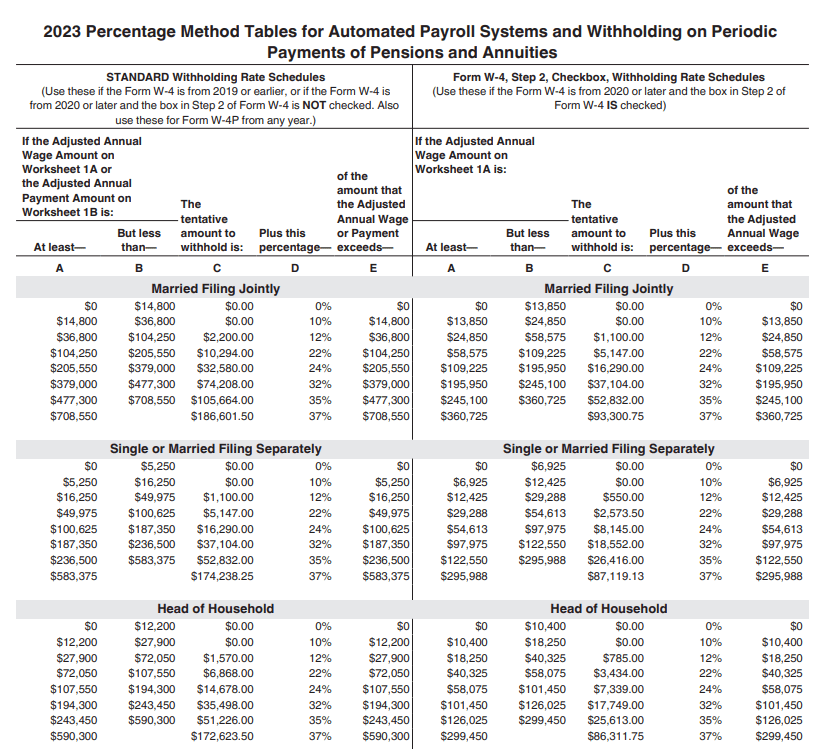

Employers use the employee’s W-4 and W-4P forms to calculate the amount of federal income tax to withhold from each paycheck. The IRS provides employers with tables that indicate the appropriate amount of federal income tax to withhold based on the employee’s income and filing status. The withheld taxes are then reported and paid to the IRS on a regular schedule.

How to Calculate Federal Income Tax Withholding

To calculate federal income tax withholding, employers use the information provided on the employee’s W-4 form, as well as the IRS withholding tables. The IRS provides an estimator on its website to help employers calculate the appropriate amount of federal income tax to withhold.

For starters, here are the tax rates for different slabs for your reference:

2. Social Security Tax

Social security tax is a federal tax that both employees and employers pay to fund the Social Security program. The federal government sets the social security tax rate, and it is subject to change each year.

Employees and employers each pay a percentage of the employee’s wages into the social security program. The social security tax rate for employees is currently 6.2% of wages up to a certain limit, while the employer pays an additional 6.2%.

3. Medicare Tax

Medicare tax is a federal tax that both employees and employers pay to fund the federal medicare program. Similar to social security, the federal government sets the medicare tax rate, and it is subject to change each year.

Employees and employers each pay a percentage of the employee’s wages into the medicare program. The medicare tax rate for employees is currently 1.45% of all wages, and the same is for employers at 1.45%.

Important Considerations

Employers must ensure they withhold and remit each employee’s correct social security and medicare taxes. The rates for these taxes are subject to change each year, and employers must stay current on any changes to ensure compliance.

4. Federal Unemployment Tax (FUTA)

FUTA is a federal tax that employers pay to fund the unemployment insurance program. Unlike the federal taxes we’ve discussed previously, FUTA is not withheld from employee wages, and the employer pays the entire tax.

Employers pay FUTA tax on a portion of each employee’s wages up to a certain limit. The FUTA tax rate is 6% of the first $7,000 in wages paid to each employee annually.

For example, if your company employs 20 individuals and the taxable income for ten is $8,000 per year, and for the rest, it is $6,000. In this case, you’ll pay the following amount as FUTA tax:

- For those with $8,000 annual taxable income: 0.06 x $7,000 x 10 = $4,200

- For those with $6,000 annual taxable income: 0.06 x $6,000 x 10 = $3,600

Businesses should calculate FUTA tax every quarter. If your business payroll liability for FUTA is $500 or less for a calendar quarter, you can roll over the tax liability to the next quarter.

However, in the fourth quarter, even if your tax liability is less than $500, you’ll have to make the payment.

To report FUTA tax, you must file Form 940 by January 31 every year for the previous calendar year. For example, your FUTA tax liability for 2021 is to be filed via Form 940 by January 31.

State and Local Payroll Taxes

In addition to federal payroll taxes, employers are also responsible for paying state and local payroll taxes. These taxes vary depending on the state and locality in which the employer operates.

Here are some common types of state and local payroll taxes:

1. State Unemployment Insurance (SUI)

State unemployment insurance is similar to FUTA but at the state level. Employers are required to pay SUI tax on a portion of each employee’s wages up to a certain limit.

In most US states, the SUI tax is an employer-only tax. However, in Alaska, New Jersey, and Pennsylvania, employees are also required to pay SUI tax. If an employer has employees in these states, the SUTA tax is withheld from their wages and remitted to the state.

Moreover, certain businesses in some states may be exempt from paying SUTA tax. For instance, in some states, nonprofit organizations and businesses with only a few employees may be exempted from paying state unemployment taxes. It’s important for you to familiarize yourself with the specific rules and regulations in your state regarding SUTA tax, as failure to comply with these regulations could result in costly penalties.

To calculate SUI tax, employers multiply the employee’s wages by the current SUI tax rate (check your state tax rate here). Employers then remit the SUI tax to the state on a regular schedule.

2. State Income Tax Withholding

In addition to federal income tax withholding, employers in many states (excluding Alaska, Florida, New Hampshire, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming) are also required to withhold state income tax from employees’ wages. The amount of state income tax that must be withheld varies by state and can depend on factors such as the employee’s income and filing status.

Hence, you should check with your state’s finance and revenue department. If you still have trouble finding the rates and similar info, feel free to reach out to us.

How Do You Manage Payroll Taxes?

Managing payroll taxes can be a complex and time-consuming task, but it’s essential for employers to stay compliant with tax laws and avoid penalties.

Here are some tips for managing payroll taxes effectively:

Use Payroll Software

Payroll software can automate many of the tasks involved in managing payroll taxes, such as calculating and withholding taxes, generating tax forms, and remitting taxes to the appropriate authorities. Investing in reliable payroll software can save time and reduce the risk of errors.

Stay Up to Date on Tax Laws

Payroll tax laws can change frequently, so employers need to stay up to date on any changes that may affect their tax obligations. This may involve monitoring changes to federal, state, and local tax laws, as well as any changes to tax rates or filing deadlines.

Keep Accurate Records

Employers should maintain accurate records of all payroll tax payments and filings, as well as any correspondence with tax authorities. This can help ensure that employers have the documentation they need to support their tax filings and respond to any inquiries or audits.

Work with a Tax Professional

Employers who are unsure about their tax obligations or struggling to manage their payroll taxes may benefit from working with a payroll tax professional company like IBN Tech. We can provide you with guidance on tax compliance, help with tax planning, and assist with tax filings and audits. Or, if you want, handle the entire payroll processing for you.

Plan for Cash Flow

Payroll taxes can represent a significant expense for many employers, so it’s essential to plan for cash flow to ensure that tax obligations can be met. This may involve setting aside funds for payroll taxes in advance or working with a lender to secure financing to cover tax payments.

How Do You Create the Employee Payslip?

Given that you’ve understood the tax deductions you’ll have to make from your employee compensation, here is how you can create their payslip:

Gather Employee Information: Collect all of the necessary information for the employee, including their name, address, social security number, and tax withholding information, including tax forms.

Calculate Gross Pay: The employee’s gross pay for the pay period is the total amount they have earned before any deductions.

Calculate Deductions: Determine the various deductions that will be made from the employee’s paycheck, such as federal and state income tax, Social Security and Medicare taxes, and any voluntary deductions, such as retirement plan contributions or health insurance premiums.

Calculate Net Pay: Subtract the total deductions from the gross pay to arrive at the employee’s net pay for the pay period.

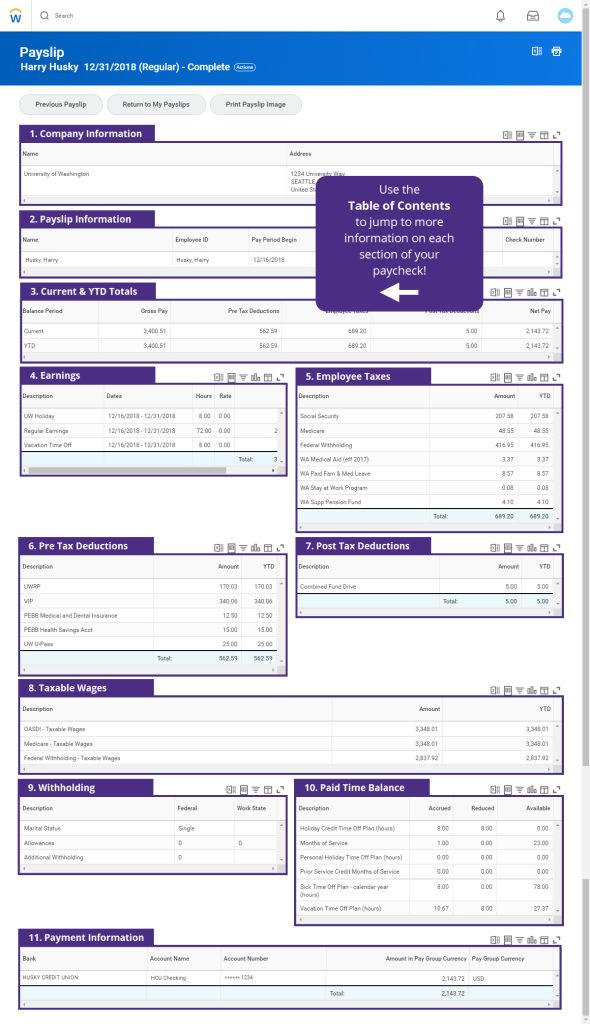

Create a Pay Stub Template: Use a pay stub template or software to create a payslip document that includes the employee’s name and address, the pay period dates, gross pay, deductions, and net pay.

Include Year-to-Date Information: Add a section to the payslip that includes the employee’s year-to-date earnings and deductions and any other relevant information, such as vacation time or sick leave accrued.

Distribute the Payslip: Provide the completed payslip to the employee in paper or electronic form, depending on the company’s payroll practices.

Retain Records: Keep a copy of the payslip for your records and any other payroll information, such as tax filings and employee contracts.

Here is what a typical payslip looks like:

Lastly, it is important to ensure that all information is accurate and that all required tax and withholding information is included on the payslip. If you are unsure of how to calculate deductions properly or create a payslip, consider using payroll software or outsourcing your payroll to a professional payroll provider.

Outsourcing is the Best Foot Forward for Payroll Tax Management

Payroll outsourcing is an effective approach for managing payroll taxes, particularly for small-mid-scale businesses that may not have the resources to manage their payroll in-house.

By outsourcing payroll processing, businesses can benefit from the expertise of a specialized team dedicated to ensuring compliance with tax laws and regulations.

Outsourcing payroll can help businesses manage payroll taxes better by:

Minimizing Errors: A specialized payroll outsourcing provider has the experience and knowledge to ensure that payroll taxes are calculated and reported accurately, minimizing the risk of errors and avoiding costly penalties.

Ensuring Compliance: Payroll outsourcing providers stay up-to-date on the latest tax laws and regulations, ensuring that businesses comply with all tax obligations.

Providing Transparency: Payroll outsourcing providers offer detailed reports that help businesses understand their tax obligations and ensure that they pay the correct taxes.

IBN Technologies is a great option for outsourcing payroll processing. We provide comprehensive payroll outsourcing services that include everything from calculating payroll taxes and generating tax forms to remitting taxes to the appropriate authorities.

Our experienced team of payroll specialists can help you manage your payroll taxes effectively, ensuring compliance with tax laws and minimizing the risk of errors and penalties.