Maintaining accounts receivable best practices can be a daunting task for bookkeeping services for small businesses. There are so many things to remember, and it can be difficult to keep track of it all. That’s where automation comes in. Automation can help you stay organized and efficient, which is essential for maintaining good financial practices. In this blog post, We’ll explore the six services that accounts receivable automation systems use the most frequently.

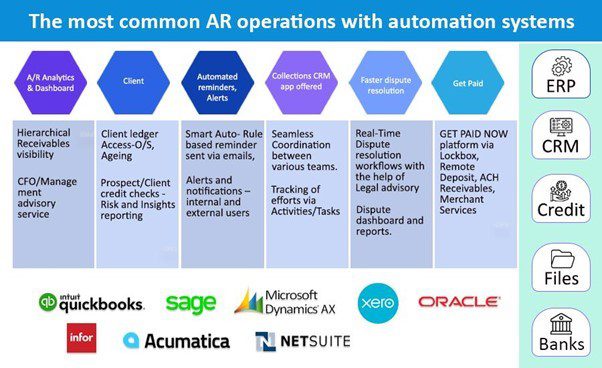

The most common AR operations today with automation systems are:

In many different businesses, AR operations may automate a wide range of tasks. The following are a few typical scenarios of AR operations performed with automation systems today.

1.A/R Analytics & Dashboard – key features

- Hierarchical Receivables visibility: A/R analytics and dashboard systems with hierarchical receivables visibility allow businesses to view and track their A/R data at different levels of the organization. For instance, a corporation might be able to access A/R data at the corporate, departmental, regional, or customer levels. In order to enhance their A/R operations, organizations may use this information to find trends and patterns in their A/R data.

- CFO/Management advisory services: CFOs and other senior managers can use some A/R analytics and dashboard systems’ advisory services to assist them to make more educated choices regarding their A/R operations. These services could include customized dashboards and reports in addition to insights and advice derived from data analysis.

- Sales / Finance visibility: A/R analytics and dashboard tools can also give employees insight into a company’s sales and financial operations, assisting them in monitoring key performance indicators (KPIs) and pinpointing opportunities for development. This can involve keeping tabs on sales goals and quotas as well as keeping an eye on the effectiveness and efficiency of the finance team in running the A/R activities.

In general, A/R analytics and dashboard systems can offer a variety of essential features and services to assist firms in streamlining their A/R operations and enhancing their financial success. These tools can support firms in making data-driven decisions and adopting a more proactive approach to managing their A/R by delivering real-time data and insights.

2.Client – key features

A client ledger is a record of financial transactions that a client has with a business. It typically includes information about the amount of money that the client owes, as well as the terms of payment and any relevant due dates. The client ledger may also include other details about the transaction, such as the date of the transaction and a description of the goods or services provided.

- Client ledger accessAccess to a client ledger is important for businesses to keep track of their financial transactions with their clients and to ensure that they are being paid on time. It can also be useful for identifying any potential issues or risks with a particular client, such as if they have a history of not paying on time or if they have a high level of debt.

- AgingAging refers to the length of time that a client’s debt has been outstanding. This information is typically included in a client ledger and can be used to identify which clients may be at risk of not paying their bills on time.

- Prospect/Client credit checks

Prospect/client credit checks are a way for businesses to assess the creditworthiness of potential clients or customers. This can be useful for businesses that are considering extending credit to a client or that want to ensure that they are working with financially stable clients.

- Risk and Insights reporting

Risk and insights reporting can provide businesses with detailed information about a client’s financial situation, including their credit history, payment history, and any potential risks or issues that may arise in the future. This can help businesses make informed decisions about whether to extend credit or enter into a financial relationship with a particular client.

3.Automated reminders, Alerts – key features

A collections CRM app can help businesses manage their client relationships and financial transactions more efficiently, by providing a centralized platform for communication, tracking efforts and tasks, and automating responses to client inquiries.

4. Collections CRM app offered – key features.

A collections CRM (customer relationship management) app is a tool that helps businesses manage their financial transactions and client relationships.

Collections CRM app provides a centralized platform for communication and collaboration, a collections CRM app can help ensure that all team members are on the same page and working towards the same goals.

Another important feature of a collections CRM app is the ability to track efforts via activities and tasks. This app can help businesses manage their client relationships and financial transactions more efficiently, by providing a centralized platform for communication, tracking efforts and tasks, and automating responses to client inquiries.

5.Faster dispute resolution – key features

It can help to minimize the impact of disputes on their financial performance and operations. There are several key features that can help businesses resolve disputes more quickly:

- Tracking and managing promise to pay

- Real-time dispute resolution workflows

- Legal advisory team

- Auto escalation

- Early detection of issues and root causes

- Dispute dashboard and reports

- Overall, these features can help businesses resolve disputes more quickly and efficiently, minimizing the impact on their financial performance and operations.

8.Get Paid – Key features.

“Get Paid” is a term that refers to the process of receiving payment for goods or services that have been provided. There are several key features that can help businesses get paid more quickly and efficiently:

- GET PAID NOW platform: It is a financial technology platform that provides businesses with access to a range of payment and collections tools. These tools may include lockbox, remote deposit, ACH receivables, and merchant services, among others. These tools can help businesses streamline their payment and collections processes and may also offer low credit card processing fees.

- Invoice factoring services: Invoice factoring is a financial service that allows businesses to sell their outstanding invoices to a third party at a discount in exchange for immediate payment. This can be an effective way for businesses to get paid more quickly, especially if they have clients who take a long time to pay their invoices.

Overall, these features can help businesses streamline their collections and payment processes and get paid more quickly and efficiently.

Conclusion

IBN Tech offers A/R automation and provides more than simply the option to utilize bots to make jobs simpler. Offering the best-outsourced accounting services supports end-to-end functions of accounting to make the most of process reform and data analytics. Ready to discover what IBN Tech can achieve for your company?