While most people are aware that small business accounting is necessary for paying taxes, they may not know about the numerous advantages it provides for growing, improving, and expanding their business.

It’s impossible to keep track of your cash flow without documenting important financial information, no matter how good you are at making mental notes and numbers.

Also, accounting reports enable you to share all the crucial data with important people like stakeholders and employees. On top of that, accounting reports also help you make educated financial decisions.

This article will explore everything you need to know about small business report accounting.

Let’s start with what exactly accounting reports are.

What are Accounting Reports?

An accounting report is a compilation of financial information derived from an accounting firm’s monetary records. These records are used to prepare brief, customized reports for specific purposes, such as calculating product line profitability or sales by region.

Accounting reports are often synonymous with financial statements. Business owners and department managers can use accounting reports for decision-making, in addition to audit and tax purpose preparation. Going into extra detail to prepare financial reports for managers means providing a comprehensive performance description of business operations.

7 Accounting Reports You Should be Tracking

It is important to keep a close eye on the following accounting reports to maintain a firm grasp of your company’s financial well-being. Let’s discuss these reports in more detail.

1. Profit & Loss Statement

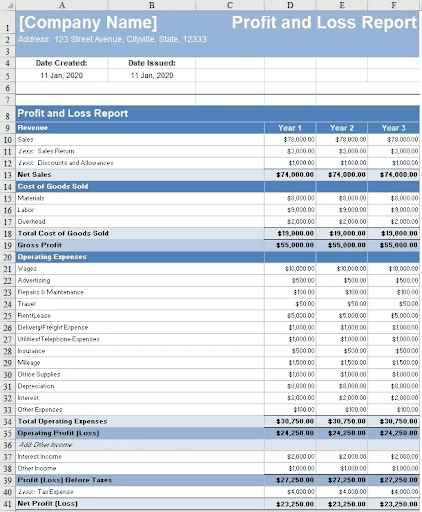

Image via FreshBooks

The P&L accounting report, aka income statement, is the most critical statement for any company. It discloses how much money a company generates, as well as other income and expense information. It includes information about where you spend and where your money comes from. For example, the money you spend on advertising, business travel, and computer and internet expenditures.

Each firm uses its own set of accounts for income and expenditure categories. Being a small company, you need to check out this accounting report at least once a month. Additionally, you should compare the most recent month to the previous few months to find out the variances in business income and expenditure throughout the financial period. It will help to evaluate and budget the spending to be incurred during the financial period as well as focus on the most profitable aspects of your company.

2. Cash-Flow Statement

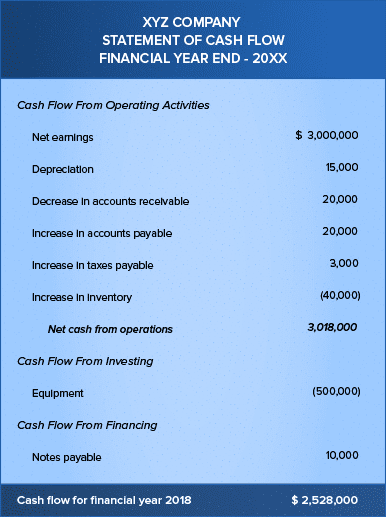

Image via Zoho

A stockpile of goods in your warehouse may make your balance sheet appear financially strong, but unless you have cash in the business, it will be difficult to run regular business activities.

A cash flow statement reveals how much cash your small business has generated and spent over a specified period of time. This accounting report breaks down cash flow as its name suggests.

All of this data assists you in making budget plans for your small business. You can use such financial information to make informed decisions for your business’s next steps.

3. Sales Revenue Report

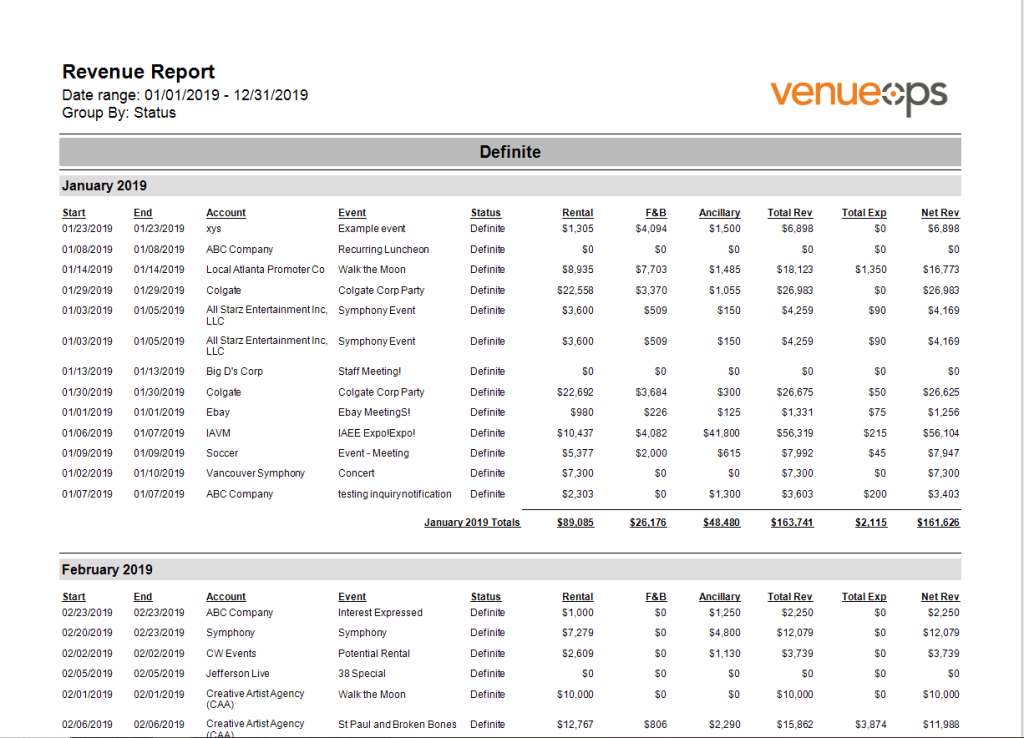

Image via VenueOps

Analyzing every item and service to see if it improves the company’s reach is important for small business owners. A sales accounting report provides information about how much of your sales revenue comes from different sources.

For example, an eCommerce business selling superhero merchandise like t-shirts, backpacks, and other items may offer unique pricing and quantities for each product to check its performance.

In addition to analyzing the revenue generated by each product, a revenue report will identify the highest revenue contributor to determine if you’re heading in the right direction.

Businesses should compare the units sold for different items to get the most from this accounting report. You can even keep track of the price of a product or service over time and compare the financial revenue of different items and services over long accounting periods (break it down by location, store, product, and so on).

4. Budget Variance Report

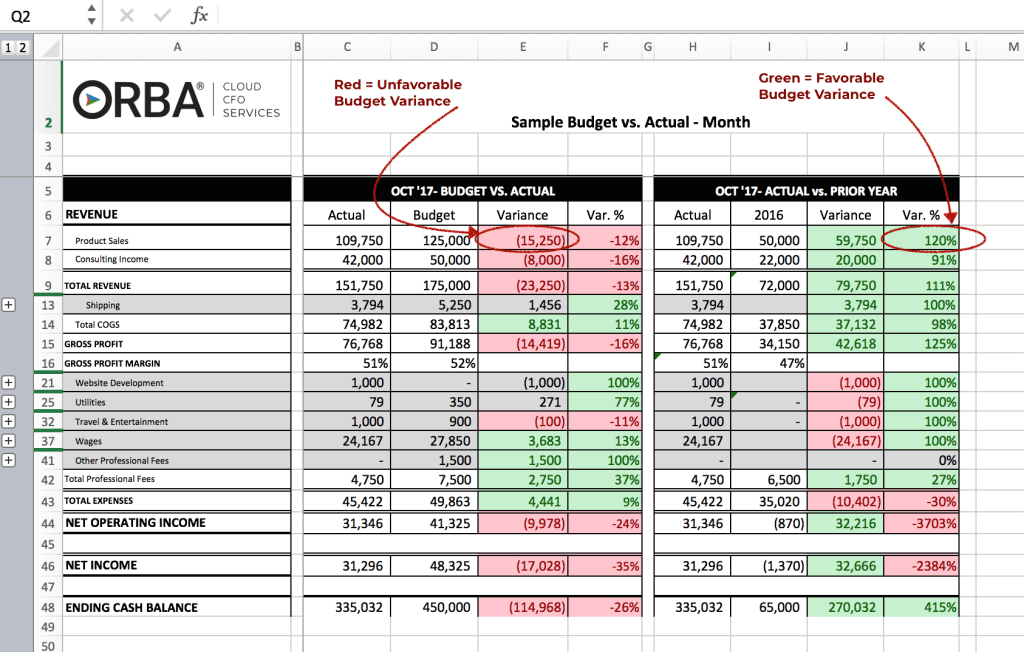

Image via OBRA

The aspect of budgeting and forecasting is also critical for your enterprise. You must determine how much money you will spend on purchases or investments over the next month, quarter, or year. These expenditures are typically based on revenue projections—i.e., the profits you expect from different product lines and departments.

Budgeted expenses or forecasted revenues can be compared to the actual results to create variance reports. They reveal how much the actual values differ from the budgeted or forecasted figures.

Make sure to generate variance acounting reports by the department. Look into the cost drivers of items with high variances to make budgeting suggestions for the next period. Also, compare variances from previous fiscal years or periods to improve your forecasting.

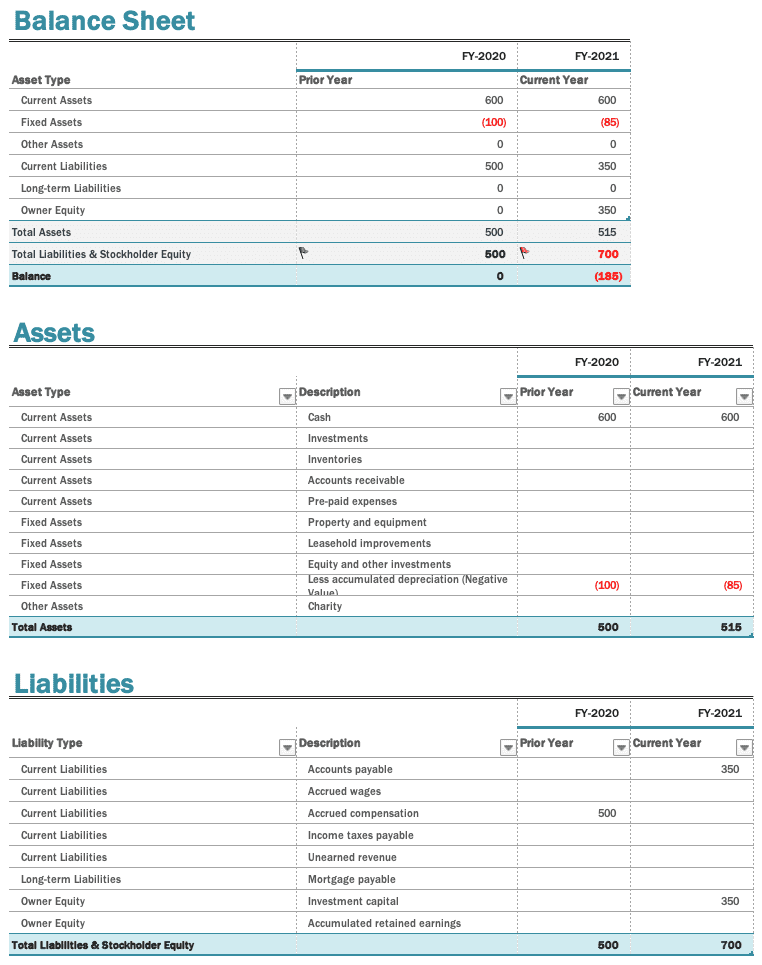

5. Balance Sheet

Image via HubSpot

The balance sheet, another very important accounting report, provides the foundation for the accounting equation, which states that assets are equal to liabilities plus stakeholders’ equity. It is preferable for the difference between what you have and what you owe to be a positive number that increases over time.

Balance sheets for small businesses give a snapshot of the business’s assets and liabilities at a specific moment in time. Bank accounts, accounts receivable, and possibly an investment account are just a few of the assets that should be listed in it. Property, computers, equipment, and other physical and intangible items are also listed as fixed assets on a balance sheet in addition to other items.

Your business may owe money on credit cards, business loans, and other obligations, among other things. They’re listed in the liability section.

When taking a look at the balance sheet, also check for short-term assets versus short-term liabilities. It helps in measuring the ability to pay debt obligations and the margin of safety for measuring/meeting working capital requirements in a timely manner.

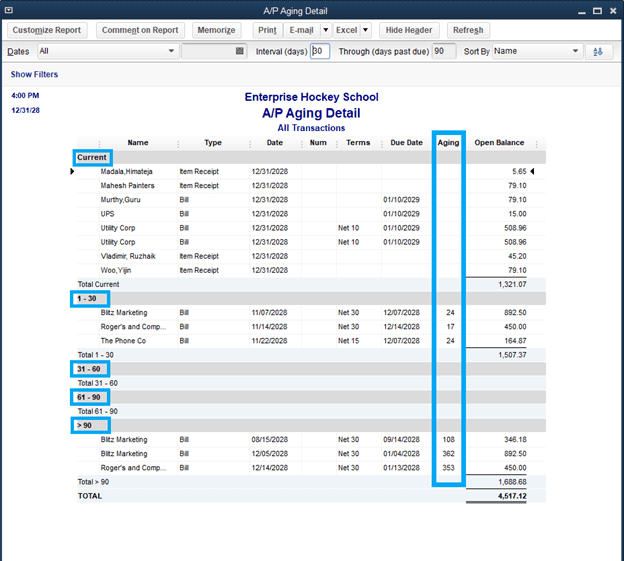

6. Accounts Payable Aging

Image via Business News Daily

Creating accounting reports like these can help you ensure that you are paying your bills on time and building stronger credibility with venders. If you neglect to pay necessary bills, your suppliers, utility providers, or insurance companies may inconveniently cut you off.

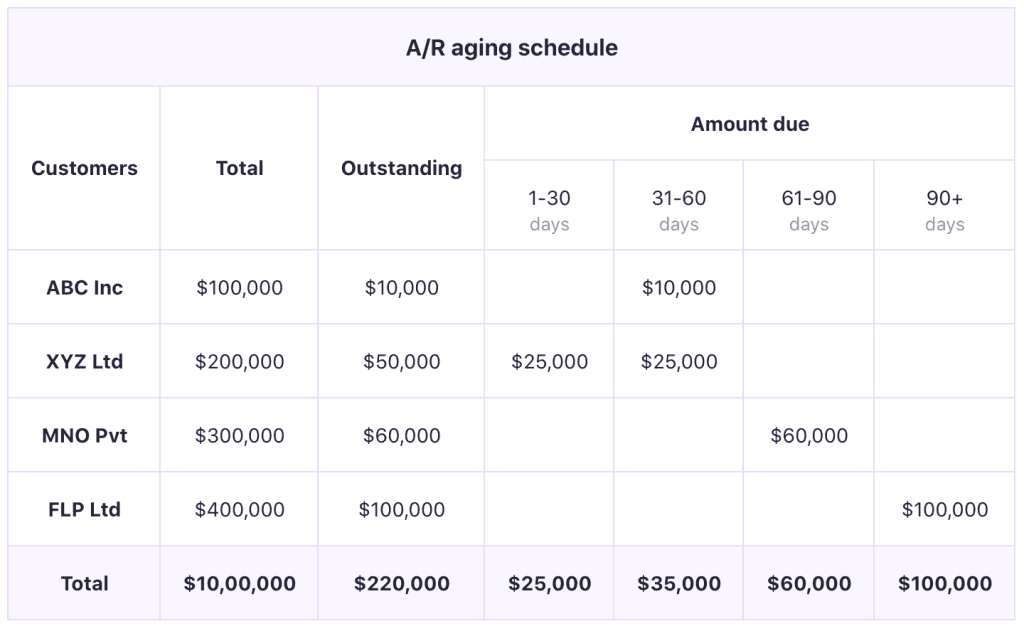

7. Accounts Receivable Aging

Image via Chargebee

You don’t want your services and products to be given away for free. When you send an invoice to your client, you may find yourself in a battle to get paid.

Your accounts receivable aging report can help you track where you stand with unpaid accounts. If you frequently have late clients or those who take advantage of your business, you should establish new policies.

How to Create Accurate Accounting Reports

Now that you know what accounting reports you’d need for your small business, it’s time to know the best practices to create them.

Know the Reader

Not every report is for everyone. While some reports will target investors, others will focus on your employees. And small business accounting reports that are intended to be placed on a stakeholder’s desk are distinct from ones that employees read.

Cash flow, for example, is a subject that’s commonly covered in such reports. Therefore, before writing the content of a small business accounting report, you must first identify who the target reader is.

Doing this will not only assist you in better managing small business report accounting, but it will also make the report much more relevant to its readers.

Gather Required Info

Gather all the financial information that’s crucial for your target audience to know. This includes monthly income and expenditure, sales percentages, income tax details, and much more.

Instead of building this information from scratch, prepare dashboards with financial data ready beforehand. This way, you won’t have to go through the hassle of finding the numbers; instead, you will be able to produce accounting reports quickly and efficiently.

Visualize the Data

Don’t go boring.

Because your report will not succeed in delivering your message if it’s lame and consists only of numbers. Your reader may attempt to scan through and extract information, but it won’t be absorbed. Even if you provide a noodle soup of accounting data, it won’t be comprehensible.

Therefore, you should create charts and graphs that are simple to glance through and understand. To accomplish this, you should choose a chart type that the reader can easily grasp, the font should be readable, and the color contrast should be easy on the eyes. For all this, you can use tools like MagentaBI, which will enable you to create graphs and charts in no time.

Cleverly Divide the Report into Sections

An accounting report should begin with an executive summary that provides a synopsis of the information covered. You should then use data-driven graphics and graphs in the body text. Keep your language simple and your sentences short to make the report easy to read.

Finally, end with a conclusion. Here, you will evaluate the data and/or propose future courses of action.

Use the Right Tech Stack

It can be difficult to keep up with the constant alterations in business management without accounting technology. These accounting technology tools can help you keep up with accounting and provide strong management reporting.

You’d require tools for the following:

Data Collection

Use existing data storage platforms, such as payroll for employee information, inventory management for purchasing and storing inventory, and ERP for connecting various business processes to get comprehensive revenue and cost information (for example, how much is spent on subcontractors). In addition, you’ll receive real-time updates on these data sources.

Bookkeeping

Using accounting or bookkeeping software, you can track your expenses and unpaid invoices, generate financial statements automatically, and simplify accounting tasks. Additionally, the software saves time and effort when maintaining accurate records.

Report Presentation

A couple of clicks is all it takes to publish accounting reports using business intelligence or financial reporting software. You can use financial dashboards to present findings in an appealing manner and to customize the information for end users.

Communication

Use team communication software to distribute your reports, communicate with relevant stakeholders in separate groups, and gather feedback.

Consult Experts if You Can’t Do It By Yourself

It’s hard to handle daily operations and finances as a small business. The good news is you don’t have to accomplish this on your own bookkeeping for small business solutions can take care of multiple reports for your business which help your business growth.

You can hire IBNTech as your accounting and bookkeeping service provider. We know the best practices to create valuable reports that add to your business decisions.

If you are living in a specific location and have its own tax and other laws in specific you can take specialized bookkeeping services of that region like bookkeeping in Los Angeles, etc.